Everyone in real estate knew that 2021 has turned out to be both weird and wild, but a new report from Redfin shows that the year also broke records for days on market, average sales price, inventory and much more.

Daryl Fairweather

The report, out Monday, describes 2021 as “remarkable.” Redfin Chief Economist Daryl Fairweather added in the report that “the ongoing pandemic, including its seismic effect on the U.S. economy and the way Americans live and work, has made 2021’s housing market anything but typical.”

Fairweather went on to point to a number of trends that influenced the year’s housing market including building supply shortages and low mortgage rates.

“Buyers paid more for homes, bought sooner than they planned, searched outside their hometowns or all of the above,” Fairweather added. “This year’s frenzied housing market has been one for the books—but it may become more balanced in 2022.”

The report then identifies numerous records that fell this year:

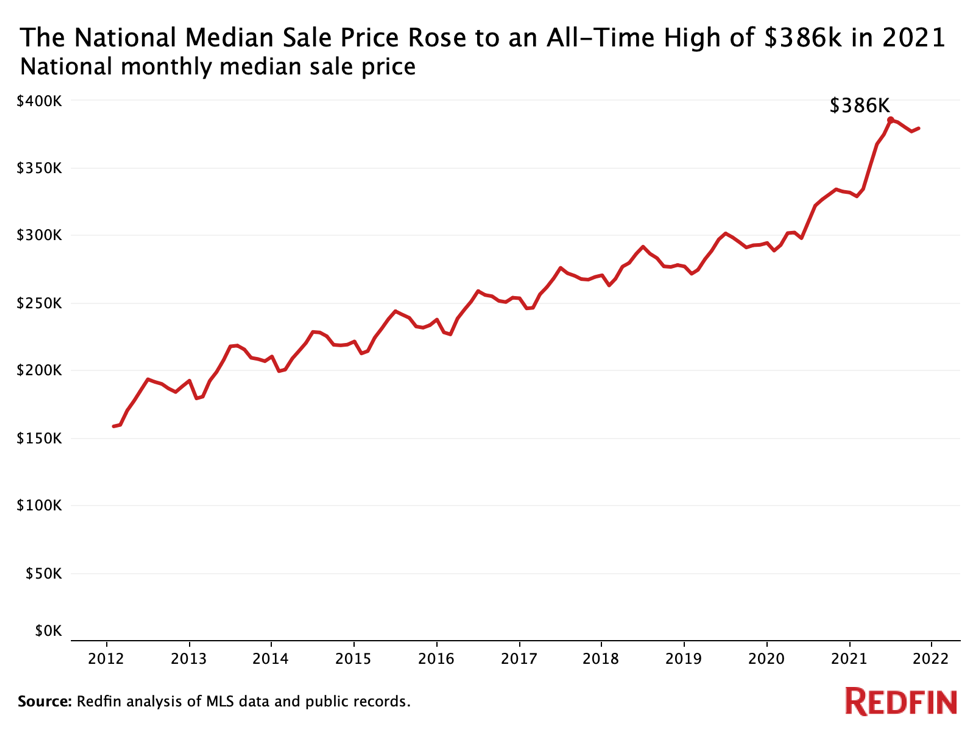

Median sales price

The median home sales price in the U.S. peaked in June at $386,000, which the report describes as an all-time high. That number also represents a 24 percent jump compared to last year.

“Prices are much higher than they were pre-pandemic in just about every part of the country,” the report notes, adding that June’s peak could actually still be eclipsed by a new all-time record before 2021 ends.

Credit: Redfin

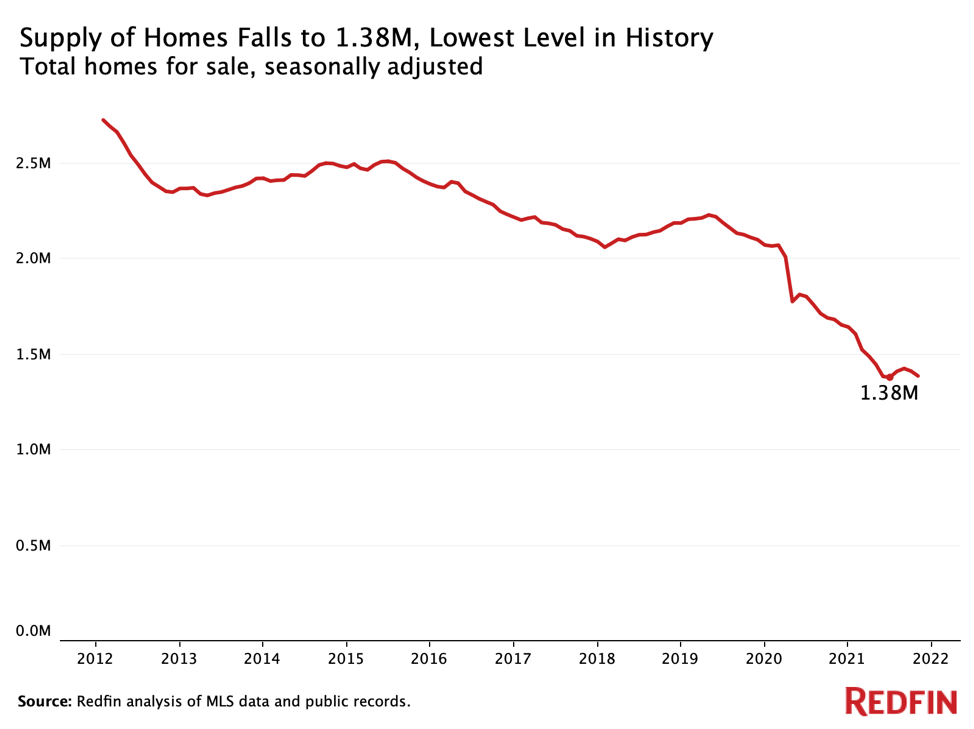

Record low home supply

This year also saw record-low inventory, with numbers dropping to 1.38 million homes for sale in June on a seasonally adjusted basis. The report blames the issue on a lack of building, surging demand and low mortgage rates.

Credit: Redfin

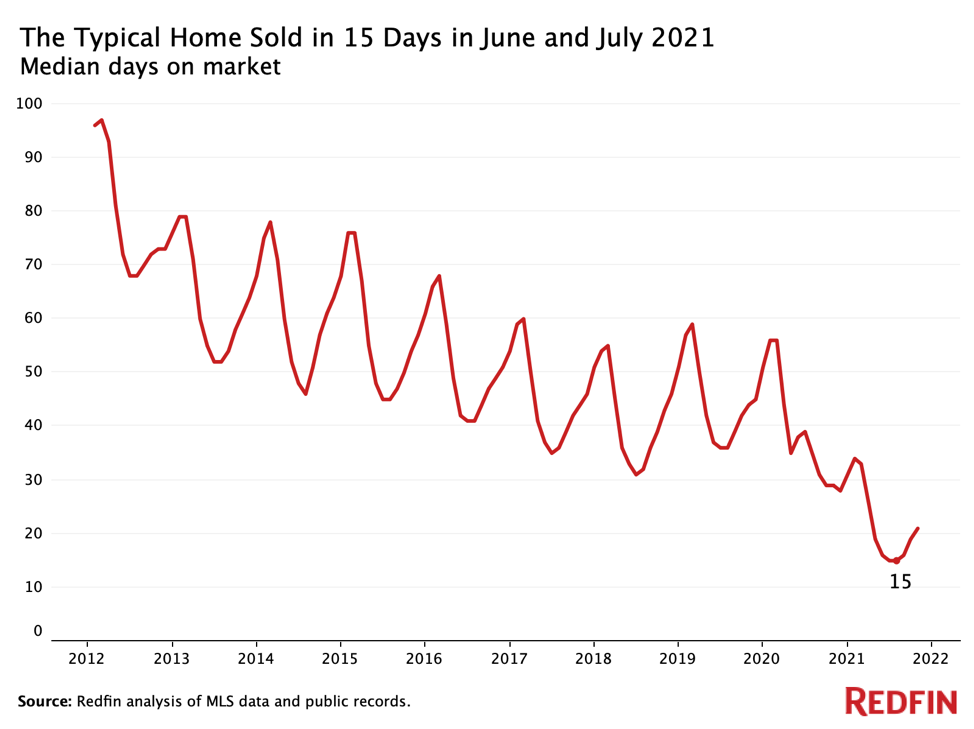

Days on market hit 15

On average, homes in both June and July sold in just 15 days, which Redfin described as the “lowest median days on market in history and down from 39 days in June 2020.” Days on market has since grow slightly, but is still shorter than during any period since 2012.

Credit: Redfin

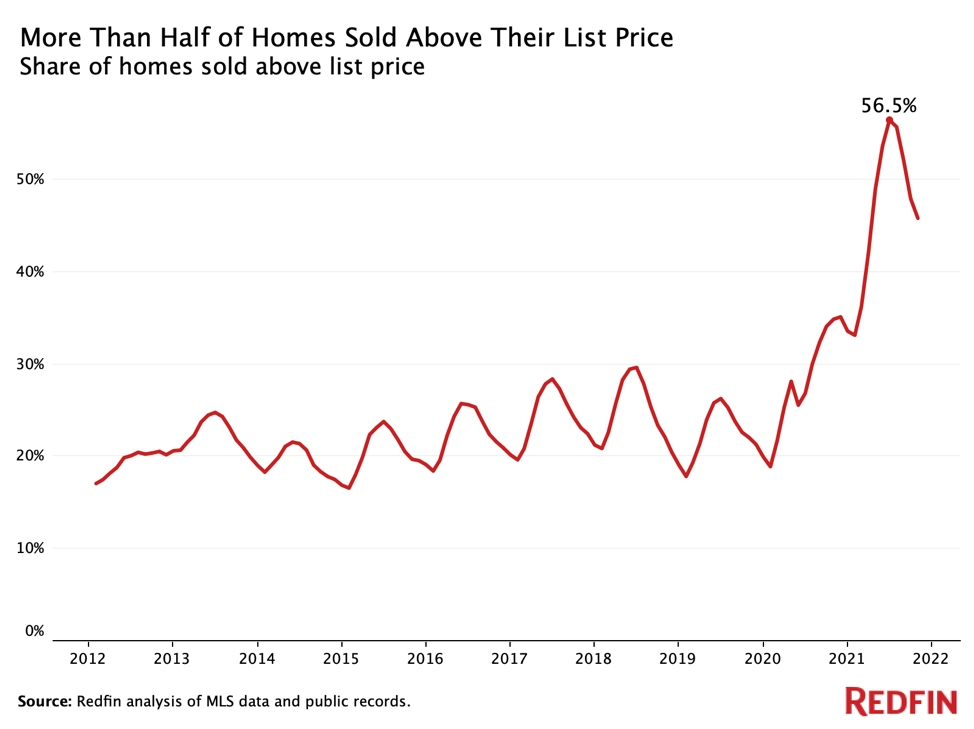

Most homes sold for more than their asking price

In June, 56.5 percent of homes sold for more than their listing price. The report describes that figure as a “record high and up 29.6 percentage points from a year earlier.” This situation appears to have been driven by bidding wars, the report adds.

Credit: Redfin

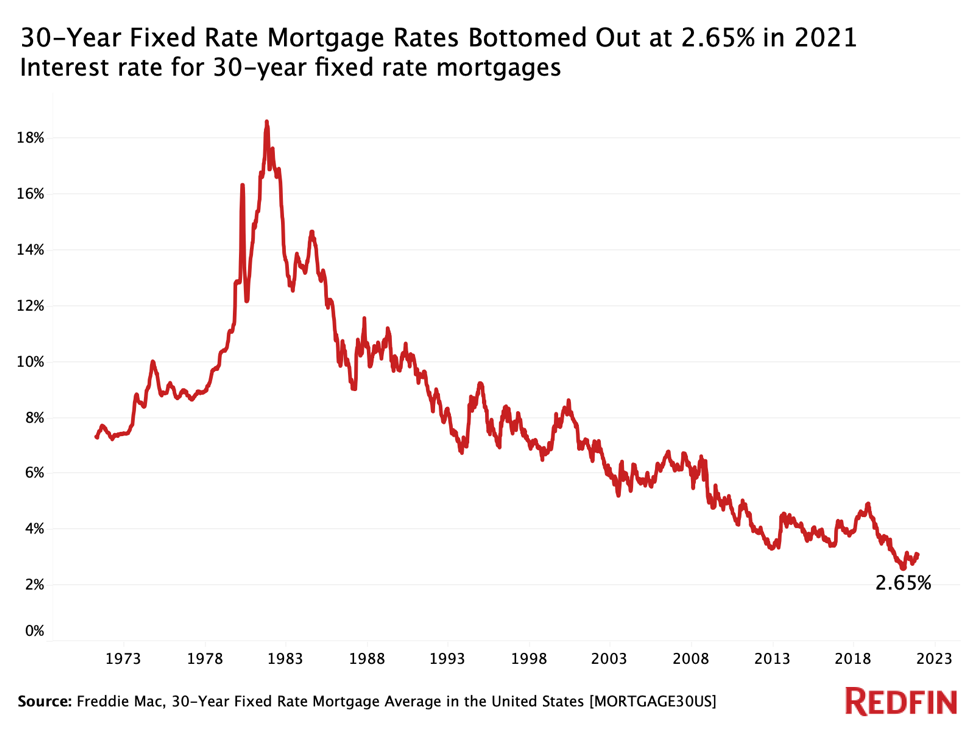

Mortgage rates plummeted

In early January, average rates for 30-year fixed mortgages bottomed out at 2.65 percent, which Redfin describes as an all-time low.

“Low mortgage rates are one reason for this year’s homebuying frenzy, which has ultimately resulted in the supply shortage and surging prices,” the report notes.

Credit: Redfin

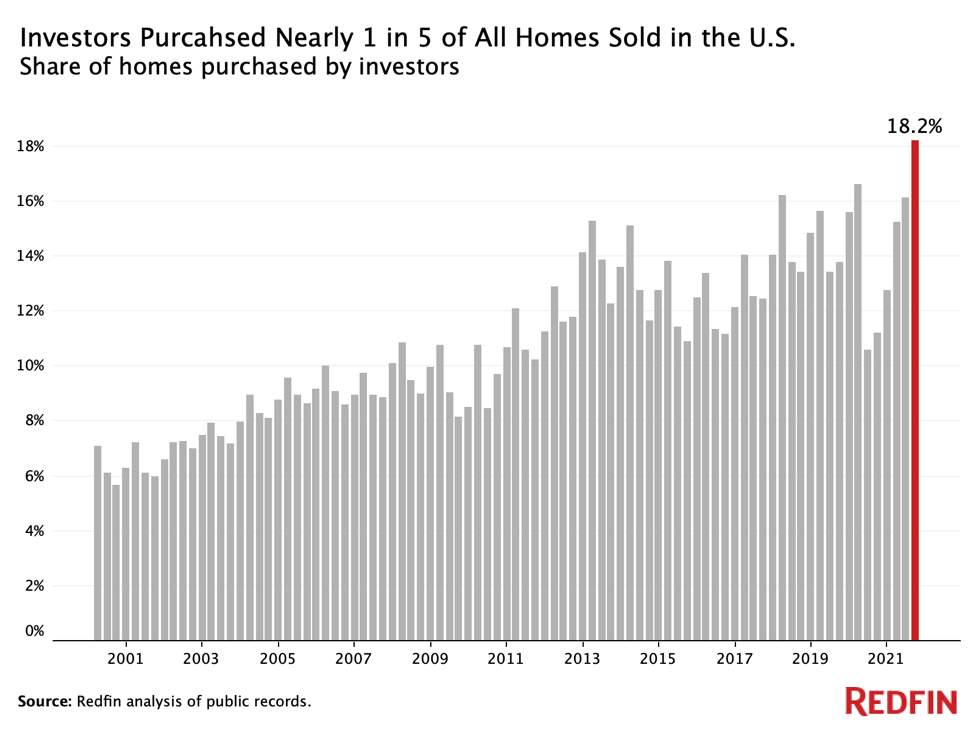

Investors bought nearly 1 in 5 houses

In total, Redfin reported that investors bought 18.2 percent of all homes that sold during the third quarter of the year. That’s up from 11.2 percent during the same period last year, and represents a record high.

“In dollar terms, investors bought a record $63.6 billion worth of homes over that period, up from $35.7 billion a year earlier,” the report adds.

Credit: Redfin

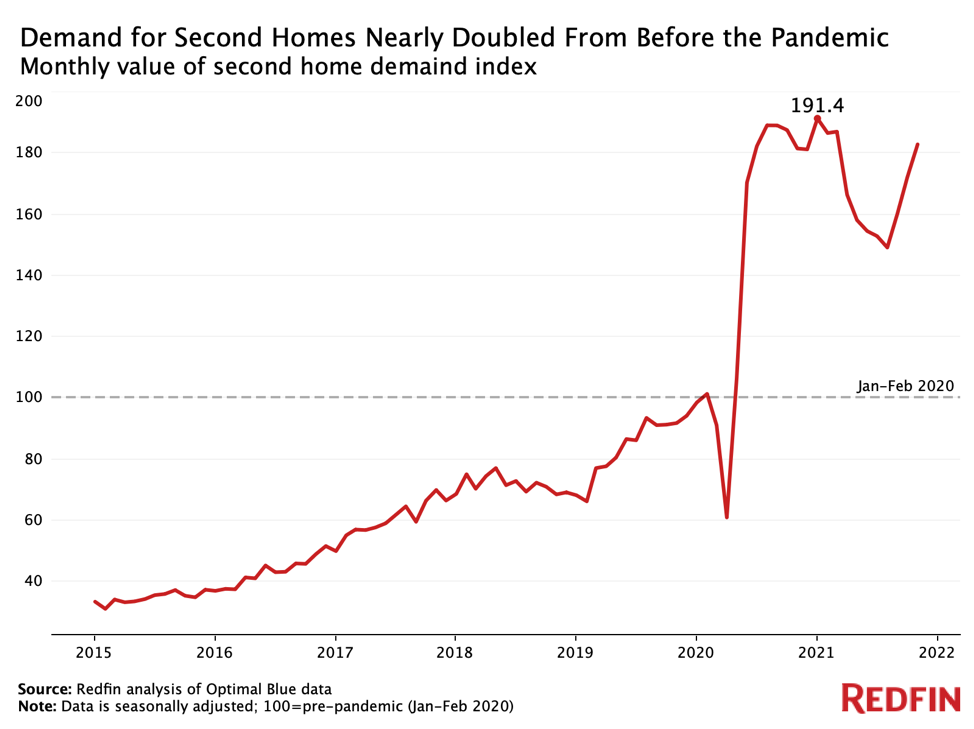

Second home demand surged

Thanks in part to new remote work policies, many office workers had the ability to work from new locations, including beach houses and ski chalets, the report notes. The result was a surge in interest in second homes and vacation properties.

“Homebuyer demand for second homes was up 91% from pre-pandemic levels in January, marking record growth,” the report revealed.

Credit: Redfin

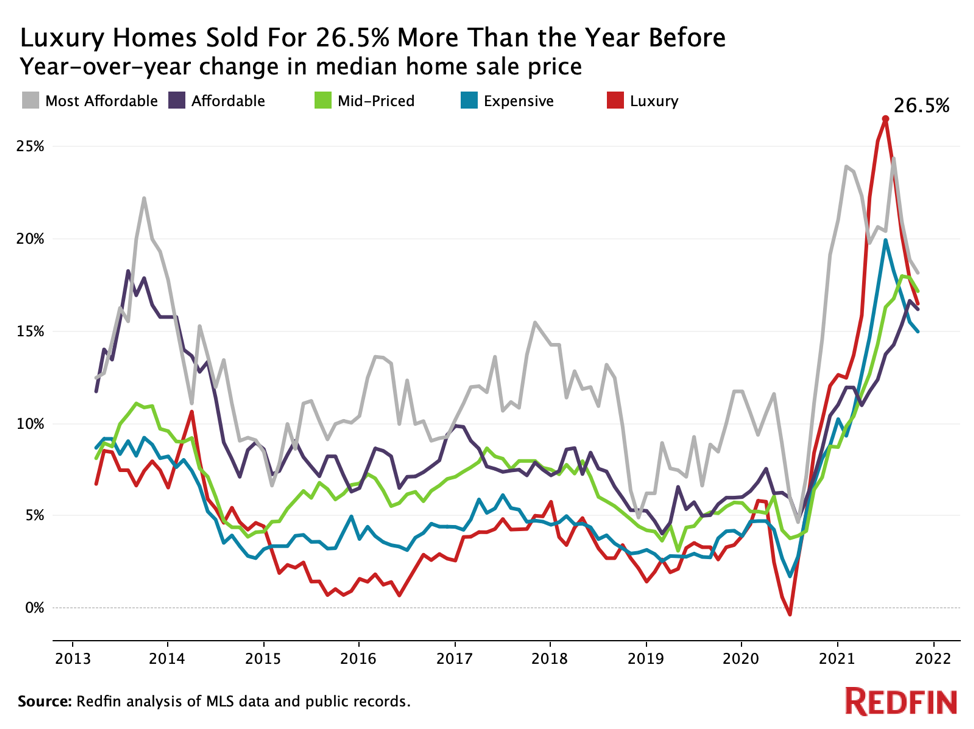

Luxury homes sold for way more

Redfin also found that the median sales price of a luxury home climbed 25.8 percent year-over-year during the second quarter of 2021, ultimately hitting $1. 025 million. That price growth handily beat other segments of the housing market, and Redfin attributes this phenomenon to “affluent Americans reaping the benefits of the year’s strong stock market, gains in home equity and remote work.”

Credit: Redfin

Redfin’s report ultimately concludes that “the coronavirus pandemic and the resulting surge in remote work have changed where, when, why and how people buy homes.”

“This past year,” the report adds, “home-sale prices hit the highest median of all time, the number of homes for sale fell to an all-time low, there was record demand for second homes, a greater share of homebuyers relocated to a different metro than ever before … and the list goes on.”

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?