Be a part of field visionaries Pete Flint, Spencer Rascoff, Ryan Serhant and a lot more at Inman Join New York, Jan. 24-26. Punch your ticket to the future by signing up for the smartest persons in genuine estate at this will have to-go to function. Sign up below.

Finance of The united states Mortgage, a nonbank financial institution that went public past year, is shutting down its wholesale and correspondent lending channels following laying off much more than 1,000 men and women this yr amid mounting losses.

The Irving, Texas-based mostly loan company is also reportedly in negotiations to promote its retail property finance loan division, which employs about 1,000 mortgage originators who perform out of more than 200 branch offices nationwide.

Finance of The usa Property finance loan TPO — the division of the enterprise that performs with mortgage brokers and correspondent loan providers — sent out an electronic mail discover Friday informing associates it would no extended fund brokered or purchased loans following Dec. 16.

“We realize this final decision will impact your relationships,” the notice claimed. “The FAM workforce will keep on to guarantee that your borrowers and you get the same extraordinary assistance that you have gained from us more than the a long time to guarantee that your existing pipeline with us closes efficiently and on time.”

Friday was the final working day for home loan brokers and correspondent creditors to post a new floating bank loan or comprehensive a new ahead lock to Finance of The usa, and Oct. 28 will be the previous day to lock financial loans at present in the pipeline or submit credit rating offers on previously locked loans, the corporation explained.

Finance of America’s industrial and reverse property finance loan lending operations “will continue on accepting new applications and function organization as regular,” the company claimed.

Valued at virtually $2 billion when it went general public final yr in a SPAC merger, Finance of The us Mortgage does most of its organization by its retail and buyer direct channels.

Finance of America’s loan origination channels

Mortgage originations by channel, in billions of dollars Supply: Finance of The united states quarterly report to investors

According to the Nationwide Mortgage loan Licensing System and Registry, Finance of America Mortgage’s retail division sponsors 1,094 home finance loan mortgage originators who work out of 246 department places nationwide.

In the course of the next quarter of this yr, individuals retail branches accounted for about 56 % of the company’s $4.23 billion in complete financial loan originations, with the buyer direct channel’s $256 million in production accounting for a further 6 %.

Wholesale and correspondent lending — in which Finance of The usa cash financial loans originated by its companions — accounted for yet another $1.52 billion in bank loan production or a lot more than a single-3rd of the total, the business reported in its most the latest quarterly report to investors.

Despite the fact that the nation’s most significant wholesale house loan loan provider, United Wholesale Property finance loan, suggests it will struggle for homebuyer marketplace share, another massive player in the aggressive wholesale business, Homepoint, has dramatically downsized. Some other loan providers that only dabbled in wholesale, this kind of as Guaranteed Level and loanDepot, have elected to shut those channels down.

Like many other mortgage loan loan providers, Finance of America has been compelled to downsize as soaring home finance loan charges have gutted the remarkably successful enterprise of refinancing existing homeowner’s financial loans.

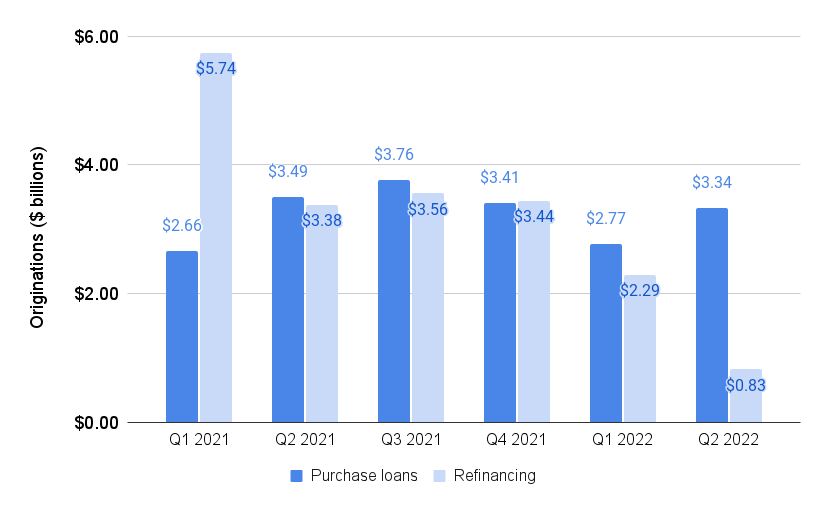

Finance of America property finance loan refinancings plummet

Finance of The united states order property finance loan originations and refinancings by quarter: Finance of America regulatory filings

All through the initial quarter of 2021 — when prices on 30-year preset-charge home loans strike an all-time small of 2.65 per cent — Finance of The us refinanced an all-time substantial of $5.74 billion in mortgages, more than twice the $2.66 billion in purchase financial loans it funded.

In its most the latest quarterly report, Finance of The us posted a $168 million 2nd-quarter internet decline, with soaring property finance loan rates seriously curtailing refinancings. Though second-quarter acquire bank loan volume climbed to $3.34 billion, refinancing volume plummeted to $825 million.

Graham Fleming

On an Aug. 4 conference phone with investment decision analysts, interim CEO Graham Fleming reported the company experienced made staffing reductions in mortgage originations “to match capability with present-day market demand from customers,” a go that he said was expected to shave $100 million a yr in charges.

In accordance to Finance of America’s 2021 annual report, the firm employed about 5,300 people in 2021 which include 3,088 in mortgage loan originations and 1,021 in loan company expert services.

Fleming explained that given that the starting of the yr, Finance of The us experienced diminished headcount and expenditures by 20 percent enterprise-large — implying the firm has downsized by far more than 1,000 staff members.

“We are optimizing our expense composition by reductions in headcount and other price tag administration attempts,” Fleming mentioned on the earnings get in touch with. “We have moved out of the buyer direct channel that was seriously reliant on refinance potential customers, and are actively proper-sizing every single of our branches.”

With acquire loans predicted to go on to account for the lion’s share of new businesses, Fleming explained Finance of America’s retail organization “remains poised to choose benefit of this change. Now, purchase originations comprised about 85 % of our quantity. We also believe there stays sizeable possibility to provide non-mortgage loan products by our mortgage channel, and are concentrated on making out this possibility.”

Because then, Finance of The us has reportedly been in negotiations to offer its retail home finance loan division, with Assured Charge considered to be the major suitor.

Finance of America reportedly signed a nonbinding letter of intent with Guaranteed Charge, Countrywide Mortgage Skilled claimed on Sept. 29. But Certain Price has “walked absent from negotiations,” HousingWire claimed Friday, citing nameless resources.

A Finance of The united states spokesperson explained to Inman that “It is firm plan not to comment on rumors or speculation in the market.”

Even though investors have soured on Finance of America since last year’s IPO, shares in the corporation are investing over their all-time small.

Soon after briefly trading higher than $11 in April 2021, Finance of America’s share price gradually slid to an all-time low of $1.20 on Aug. 31. Rumors of an impending sale of the company’s retail mortgage division buoyed the company’s share cost, which bounced 54 % to a recent substantial of $1.74 on Oct. 4.

At Friday’s closing value of $1.60, Finance of The usa has a industry capitalization of about $100 million.

Get Inman’s Excess Credit history Newsletter delivered ideal to your inbox. A weekly roundup of all the most significant news in the globe of mortgages and closings shipped each individual Wednesday. Click here to subscribe.

E-mail Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?