Despite some setbacks, 2021 was a massive year for iBuyers, according to Mike DelPrete. With more houses bought and sold by the platforms than ever before, what’s next?

After a momentous year for iBuyers, where do instant offer companies like Offerpad, Opendoor and Redfin Now go from here? All February, Inman will dig into iBuyers to determine what the new year has in store, where opportunities lie for real estate agents and what brokerages should expect. It’s iBuyer Month at Inman.

This post has been republished with permission from Mike DelPrete.

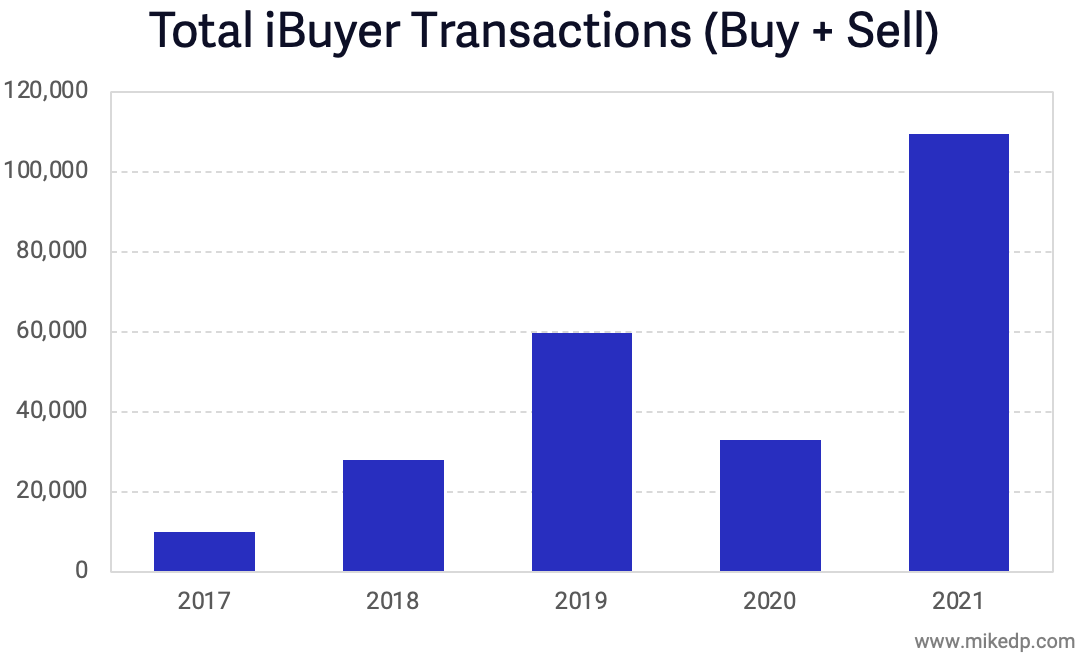

2021 was a transformative and record-breaking year for iBuyers. More houses were bought and sold by iBuyers than ever before.

Why it matters: iBuyers are one of the leading disruptive models in real estate. Their ability to grow, in all types of markets, is an important signal as to what degree the traditional real estate transaction can be disrupted.

- But while 2021 saw record-high iBuyer transactions, it also saw the implosion of Zillow Offers after the business grew too quickly.

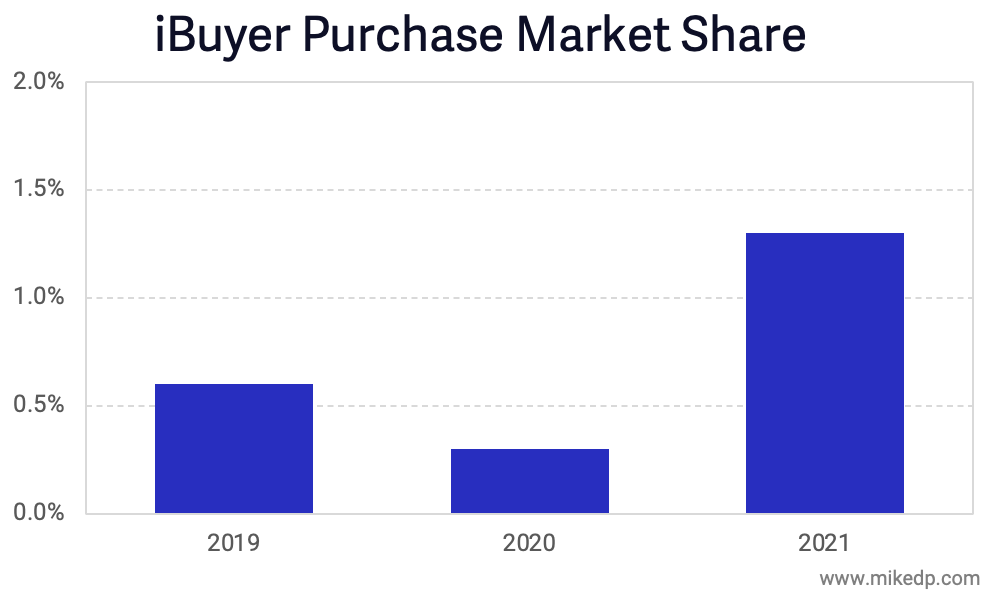

Big picture: IBuyer national market share of home purchases hit an all-time high of 1.3 percent — around 70,000 houses — in 2021.

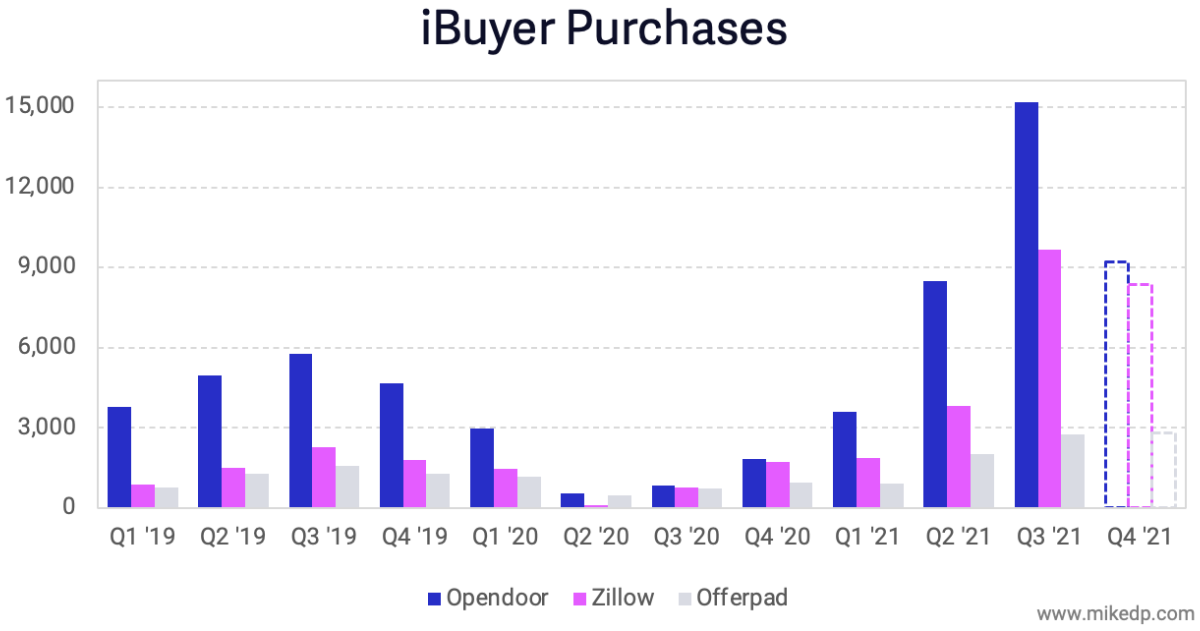

IBuyer purchases remained robust as 2021 came to a close.

- Even though Zillow stopped new purchases, it was on the hook to complete purchases that were already under contract.

- Seasonality kicked in for Opendoor as it smartly slowed purchases after a massive acquisition spree in Q3.

Note: Q4 numbers are preliminary and subject to change.

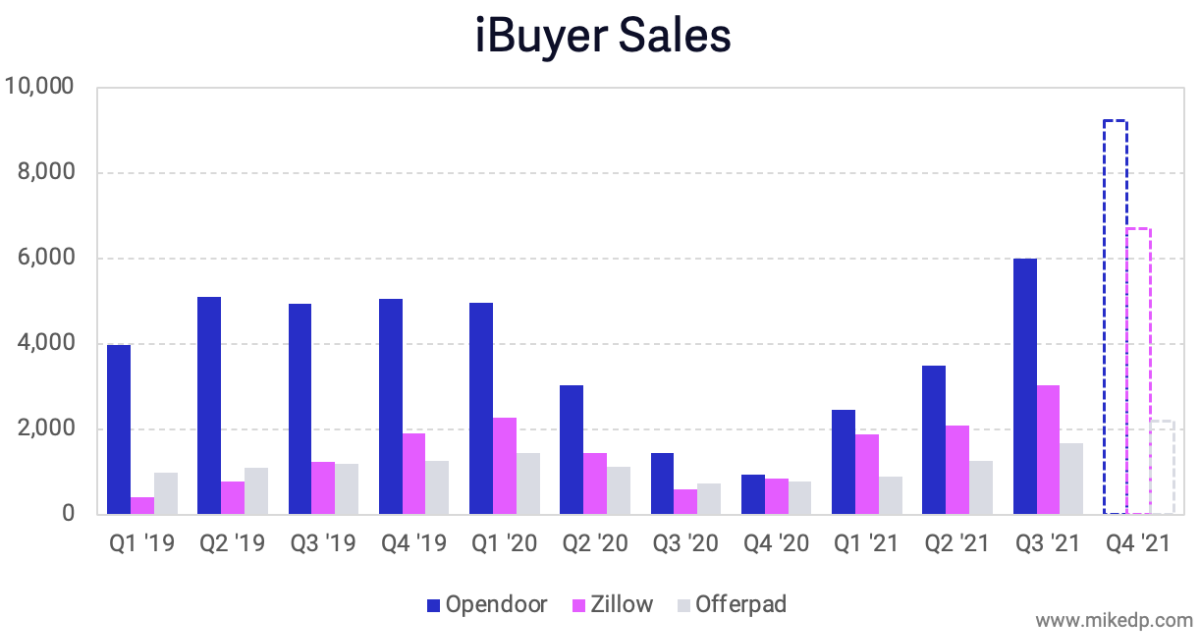

IBuyer sales set new records in Q4, with more houses sold than ever before.

- Opendoor consistently sold more houses each month, demonstrating an expanding operational capacity to repair and sell houses at scale.

- This is a critical metric to watch. Buying houses is the (comparatively) easy part; selling at scale is difficult.

Note: Q4 numbers are preliminary and subject to change.

What’s next: 2022 is all about profitability. Opendoor and Offerpad need to demonstrate that they can achieve consistently positive unit economics at scale.

- With Zillow out of the picture, there will be less competitive pressure on fees and acquisition prices.

- But Opendoor faces increasing competition from big incumbents, Power Buyers, and smaller brokerages, which have all launched similar products.

The bottom line: 2021 was a massive year for iBuyers. In particular, Opendoor is approaching the scale it promised during its IPO. If its economics fall into line, the company is poised to be a significant force in real estate.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?