Anticipating further mortgage lending industry declines into 2023, loanDepot has accelerated its plans to lay off thousands of employees and is shutting down its wholesale lending business in the hopes of returning to profitability by the end of the year.

In addition to those and other cost-cutting measures, loanDepot said in releasing second quarter earnings Aug. 9 that it will look to boost revenue by growing its purchase loan business and loan servicing portfolio, and will roll out a digital home equity line of credit (HELOC) product by the end of the year.

Foothill Ranch, California-based loanDepot posted a $223.8 million second quarter net loss as revenue dropped 39 percent from the previous quarter, to $308.6 million. That brought loanDepot’s net loss for the first six months of the year to $315.1 million, compared to $454.1 million in profits during the same period a year ago.

Frank Martell

“Like other mortgage companies, we scaled our organization during 2020 and 2021 to meet the demands of unprecedented mortgage volumes, especially refinancing transactions,” loanDepot President and CEO Frank Martell said on a call with investment analysts. “After two years of record-breaking volumes, the market has contracted sharply and abruptly so far this year.”

Martell said loanDepot anticipates that market conditions “will remain challenging over the short to medium-term, with mortgage originations projected to decline by approximately 50 percent in 2022 from 2021, including an accelerated decline in the second half of 2022. At this point, we expect to see further declines in volumes in 2023.”

Martell, the former CoreLogic leader tapped in April to succeed loanDepot’s founder Anthony Hsieh as CEO, said that with recent cost-cutting moves, the company “is positioned for long-term success, built on the support of a strong balance sheet and ample liquidity.”

Investors welcomed the moves, with shares in loanDepot clawing their way back above $2 after the earnings release, having traded for as little as $1.34 and as much as $9.35 in the past year. A number of mortgage lenders have downsized to cut costs in recent months as rising mortgage rates curtail demand for mortgages. The parent company of the nation’s biggest mortgage lender, Rocket Companies, jettisoned $300 million in expenses to narrowly avoid a second quarter loss.

5,000 workers being shed in ‘aggressive’ cost cutting

LoanDepot cut $45.6 million in expenses during the second quarter, an 8 percent reduction from the first three months of the year, putting it on track to meet a goal outlined in July to cut $375 million to $400 million in annual expenses during the last half of 2022.

Most of those savings were achieved through reduced employee compensation due to layoffs, reduced and incentive commissions.

LoanDepot had 8,540 employees on the payroll as of June 30, down 26 percent from the 11,572 employees at the same time a year ago. The company’s “Vision 2025” plan set a target of reducing loanDepot’s headcount to 6,500 by the end of the year. That would represent a total workforce reduction of 5,072 employees, or 44 percent, since June 30, 2021.

But in discussing second quarter earnings with investment analysts, loanDepot CFO Patrick Flanagan said the company now expects to not only meet, but exceed the Vision 2025 headcount reduction goal by the end of September.

Patrick Flanagan

“We plan to achieve our cost reduction goal by further reducing management spend, consolidating redundant operational functions, reducing marketing expenditures, real estate cost [including office leases] and other third-party charges,” Flanagan said. “We also continue to evaluate all aspects of our business for potential additional expense reduction as the market continues to evolve.”

According to a more detailed quarterly earnings report filed Aug. 10, loanDepot said second quarter personnel expenses were down 37 percent from a year ago, to $296.6 million. During that period, loanDepot also slashed quarterly marketing expenses by 47 percent, to $60.8 million. Those and other cost-cutting moves helped reduce total expenses by 25 percent year-over-year, to $749.4 million.

Vision 2025 long-term goals

Martell said that in addition to “aggressively right-sizing our cost structure” for expected mortgage volumes, the four primary “strategic pillars” of the Vision 2025 plan include raising the company’s focus on purchase transactions.

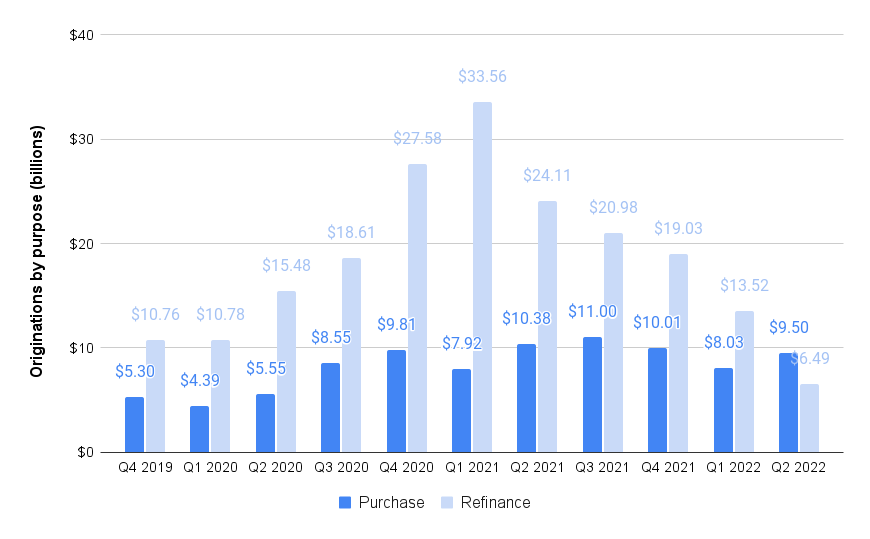

LoanDepot mortgage originations by purpose

Source: loanDepot regulatory filings.

After two consecutive quarters of declines, loanDepot’s purchase loan volume grew 18 percent quarter-over-quarter, to $9.5 billion. Purchase loans accounted for 59 percent of second quarter mortgage originations — an all-time high in records going back to 2019.

Although loanDepot did more purchase loan business during several quarters in 2020 and 2021, those loans represented a smaller share of total originations. The steep decline

“As the company pivots to an increasingly purpose-driven organization, we expect to increase our focus on addressing persistent gaps and equitable housing, while advancing the goal of growing our share of lending for purchase transactions and maintaining responsible management of credit risk,” Martell said.

Another strategic pillar is to “meaningfully progress our previously announced growth-generating initiatives, including launching a digital HELOC product later this year and continuing to leverage our investment in our servicing business,” Martell said.

Martel said the HELOC is expected to be “a very modest contributor” to the goal of reaching profitability by the end of the year, since it hasn’t launched yet.

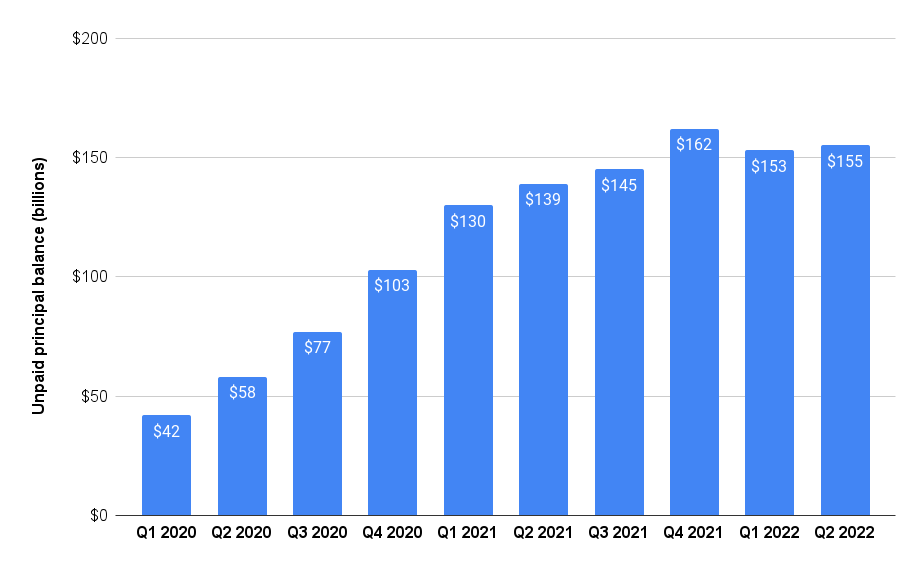

But having grown 12 percent from a year ago, to $155.2 billion, loanDepot’s servicing portfolio generated $117 million servicing income during the second quarter alone.

Growth in loanDepot servicing portfolio

Source: loanDepot regulatory filings.

Flanagan said growing the company’s servicing portfolio not only generates income, but gives loanDepot a better shot at refinancing the homeowners making payments on those loans, and marketing other services to them.

“Customer retention remains one of our primary areas of focus,” Flanagan said. “By controlling the entire customer experience and retaining data in our in-house platform, we improve our operating efficiency by capturing additional revenue opportunities and leveraging our marketing and customer acquisition expenses across multiple products and services.”

As of June 30, loanDepot was servicing 87 percent of its portfolio in-house, compared to 67 percent at the end of the first quarter, he said.

Exiting the wholesale business

Martell said loanDepot plans to stop accepting loans originated by independent mortgage brokers as part of an overall goal of providing “our superior standard of customer service throughout the home ownership journey, from marketing to underwriting and closing, to providing ancillary and complementary products and services to servicing the loan for its duration.”

“Working through third party mortgage brokers,” he said, “makes it more difficult for us to control the customer experience and adds a layer of expense that reduces our profitability.”

LoanDepot Executive Vice President Jeff Walsh said the plan is “to fund out the remaining wholesale pipeline, which is approximately $1 billion and have the entire pipeline wrapped up by the end of October of this year.”

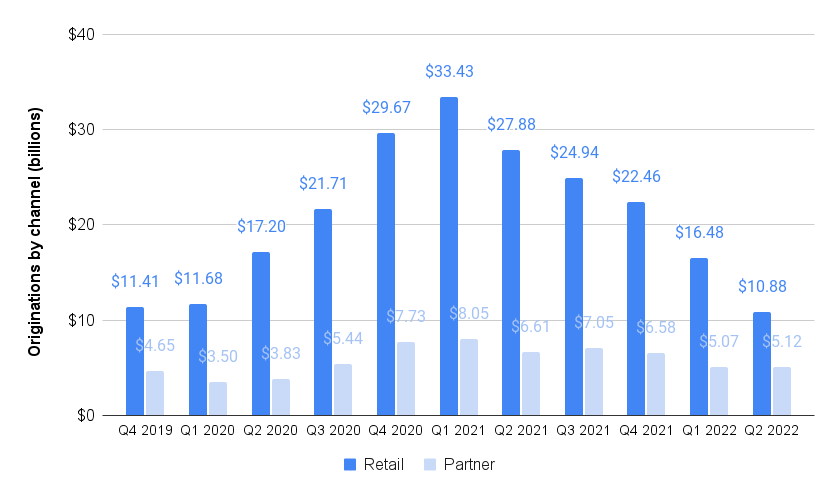

LoanDepot originations by channel

Source: loanDepot regulatory filings.

Martell said loanDepot will continue to originate loans through joint ventures with homebuilders including LGI Homes, Schell Brothers, and Brookfield Residential, which are an important source of purchase loans.

During the second quarter, loanDepot’s partner channel accounted for 32 percent of loanDepot’s originations, an all-time high in records dating to 2019.

Flanagan said one reason for the wide range loanDepot is providing in its outlook for the third quarter — it expects origination volume to come in somewhere between $5.5 billion and $10.5 billion — is because it depends, in part, on how quickly homebuilders are able to complete homes now under construction.

“Part of that range is how well our JVs do in completing inventory by year-end,” Flanagan said. “And so the volatility is what makes us need to give a wide range.”

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?