In a shifting real estate market, the guidance and expertise that Inman imparts are never more valuable. Whether at our events, or with our daily news coverage and how-to journalism, we’re here to help you build your business, adopt the right tools — and make money. Join us in person in Las Vegas at Connect, and utilize your Select subscription for all the information you need to make the right decisions. When the waters get choppy, trust Inman to help you navigate.

LoanDepot announced it will lay off 4,800 workers this year and streamline its organizational structure with the aim of cutting up to $400 million in annual expenses and become profitable by the end of the year, after rising mortgage rates gutted the company’s profitable refinancing business.

In announcing the job cuts Tuesday, the Foothill Ranch, California-based lender said it’s already laid off 2,800 of the 11,300 workers it started out the year with, with an additional 2,000 layoffs planned.

Going forward, loanDepot said it intends “to increase its focus on serving the purchase market as well as less rate sensitive cash-out refinances, simplify its organizational structure with an emphasis on client service, quality, automation and operating leverage, continue to invest in its servicing business and innovative digital consumer lending solutions, and accelerate its ongoing rightsizing.”

Patrick Flanagan

Shares in loanDepot, which have traded for as little as $1.33 and as much as $12.56 in the last year, posted double-digit gains after the announcement, in which CFO Patrick Flanagan assured investors that the company has “a strong balance sheet and ample liquidity,” with a cash position of $1 billion.

Frank Martell

LoanDepot founder Anthony Hsieh foreshadowed changes at the company when he announced in April he would be handing the CEO reins over to former CoreLogic CEO Frank Martell. Martell has been overseeing daily operations, with Hsieh taking on a “holistic strategic role” as executive chairman of loanDepot’s board.

In announcing first quarter earnings on May 10, loanDepot said it would lay off workers and suspend its quarterly dividend after posting a $91.3 million first quarter loss as it originated fewer — and less profitable — mortgages. At $21.55 billion, LoanDepot’s first quarter loan originations were down 26 percent from the previous quarter and 48 percent from a year ago.

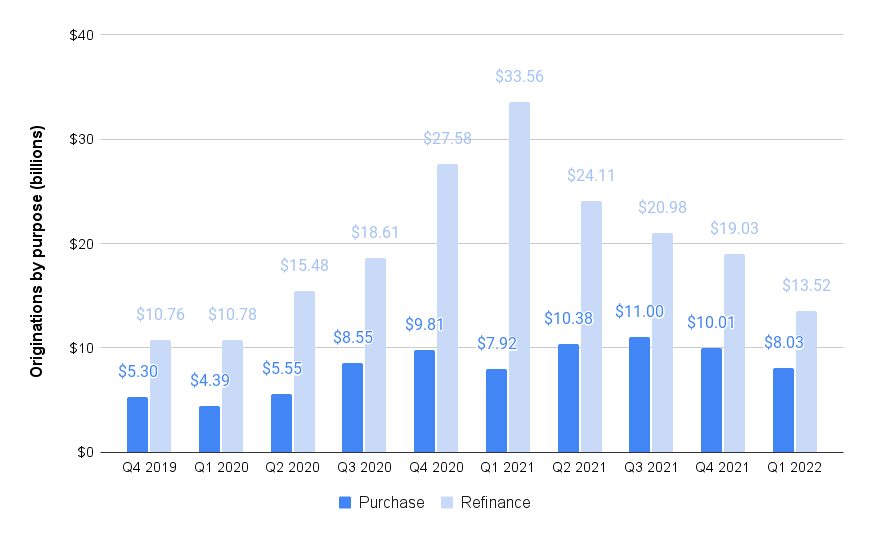

With less profitable purchase loans accounting for 37 percent of loanDepot’s originations, compared to 19 percent a year ago, first quarter profit margins were also down sharply.

LoanDepot mortgage originations by purpose

Source: LoanDepot regulatory filings.

In announcing a “Vision 2025” plan to return to profitability, Martell said that during the boom years of 2020 and 2021, “like other mortgage companies, we scaled our organization to meet the demands of unprecedented mortgage volumes, especially refinancing transactions. After two years of record-breaking volumes, the market has contracted sharply and abruptly in 2022. We are taking decisive action to meet this challenge head on.”

LoanDepot said it will centralize management of loan originations and loan fulfillment in order to build up its purchase mortgage business and increase automation.

Mortgage originations will be led by LDI Mortgage President Jeff Walsh; digital lending and mortgage-adjacent products and services will be led by LDI Digital Products and Services President Zeenat Sidi; and loan fulfillment and servicing functions will be led by LDI Managing Director of Operations and Servicing Dan Binowitz.

LoanDepot brought Sidi, a veteran of SoFi, Capital One and RBC, aboard in March to serve as president and chief operating officer of loanDepot’s new operating unit, mello. The move was a bid to expand loanDepot’s business “above and beyond mortgage products” and create “customers for life.” The unit will oversee customer relationships, develop new unsecured loan products, and house the company’s real estate brokerage, title and insurance businesses.

In a LinkedIn post aimed at recruiting loan originators, UMortgage CEO Anthony Casa predicted that loanDepot’s move will trigger more downsizing.

“The LoanDepot news will certainly result in mortgage companies with financial sponsors to pull the trigger on downsizing quicker,” Casa said. “Transactional business models will always be disproportionately impacted by market volatility; as seen in the case of Better Mortgage and now with LoanDepot.”

LoanDepot is just one of a number of mortgage and real estate companies to downsize in recent weeks, as the Federal Reserve’s efforts to combat inflation by raising interest rates raise worries about a decline in home sales and a potential recession.

Two lenders that provide riskier “non-Qualified Mortgages” to self-employed borrowers — Sprout Mortgage and First Guaranty Mortgage Corp. — have shut down in recent weeks, reportedly because they had difficulty securing funds to make new loans.

Although LoanDepot offers a non-QM loan product, Advantage Express FLEX, most of its business consists of more traditional loans. But like most nonbank lenders, loanDepot relies on short-term revolving loans known as warehouse lines of credit to fund the mortgages it originates. As a loan servicer, the company is also required to advance up to four months of principal and interest payments to investors who have purchased the loans that it collects payments when borrowers enter forbearance.

On a conference call with investment analysts, William Blair analyst Robert Napoli asked Flanagan for “a little more color” on why loanDepot executives are confident that the company has enough “liquidity” — cash and borrowing capacity from more than a dozen creditors — to navigate shifting market conditions.

In addition to “about a billion dollars of unrestricted cash” and “modest leverage” on the balance sheet, Flanagan said loanDepot has “been working throughout the year with all of our lending and trading partners with a very clear achievable path to return to profitability by the end of the year. So we’re in good standing with all of our funding sources.”

“And we think if you just look at the [$91 million] first quarter loss and compare that to $1 billion dollar cash, we think we have ample liquidity to see us through the cost-cutting measures,” Flanagan said.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

Email Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?