Join marketplace visionaries Pete Flint, Spencer Rascoff, Ryan Serhant and extra at Inman Connect New York, Jan. 24-26. Punch your ticket to the long term by signing up for the smartest individuals in true estate at this ought to-attend occasion. Sign up in this article.

Mortgage charges will keep at current levels very well into the spring homebuying time, which implies a “darker outlook for property profits, homebuilding and household price ranges,” Moody’s Analytics Chief Economist Mark Zandi explained in a sequence of tweets around the weekend, echoing a growing chorus of forecasts that recommend a recession could be unavoidable.

Zandi reported that while a preceding forecast that house loan rates would ordinary around 5.5 per cent through the spring offering season “seemed way high” at the time, but “now looks way low.”

Mark Zandi

“Fixed fees are now near 6.5 percent, a lot more than double what they ended up a year in the past when they ended up hovering close to a document reduced,” Zandi mentioned. “This has been a huge blow to affordability and the housing current market.”

The veteran economist claimed he now thinks it’s possible that mortgage loan fees will stay elevated at 6.5 per cent or larger this spring.

In their most current weekly industry outlook, economists at Moody’s Analytics claimed they now put the odds of a economic downturn at an “uncomfortably high” 59.5 p.c.

“Contrary to well-known belief, individuals are not the first to operate to the bunker, pushing the financial state into economic downturn. Instead, the to start with to flip is housing, then organization expense, followed by consumer spending,” Moody’s warned.

That is because interest premiums are usually headed up at the conclusion of an economic increase, and “housing is very desire-fee delicate.”

Ironically, a important variable driving prices greater is that traders who fund most mortgages are demanding an unusually large premium in comparison to similar governing administration bonds, out of fears that the residence loans they make now could speedily be refinanced if prices fall.

What’s confounded Zandi and other forecasters is not just the ferocious rate of Fed price hikes — “I experienced envisioned that,” he tweeted — but the escalating “spread” amongst 10-year Treasury yields and mortgage loan rates.

My forecast mistake is not since Treasury costs are up, I experienced predicted that, but since of an extraordinarily broad variance concerning the home loan and Treasury prices. This spread is the compensation that buyers and loan companies who fund, originate, and company home loans need.

— Mark Zandi (@Markzandi) September 24, 2022

Conforming home loans backed by Fannie Mae and Freddie Mac are securitized and bought to traders, who think about them just about as protected a bet as U.S. govt financial debt. Mainly because 10-year Treasurys have a similar reimbursement expression as mortgages (most home owners refinance or market their dwelling right before spending off their mortgage loan), yields on 10-year notes are considered a fantastic barometer of the place home finance loan costs are headed upcoming.

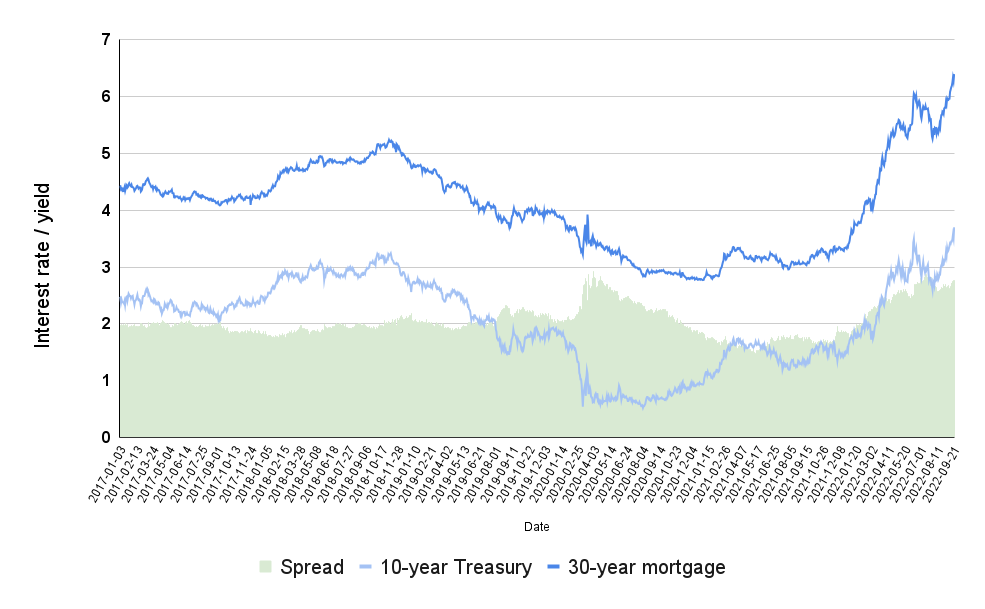

‘Spread’ between Treasury yields and property finance loan fees widens

Supply: Inman investigation of facts from Board of Governors of the Federal Reserve Technique (10-yr Treasury yields) and Optimal Blue Home loan Sector Indices (30-12 months fixed-price conforming mortgages). Data retrieved from FRED, Federal Reserve Financial institution of St. Louis.

The “spread,” or big difference amongst 10-year yields and 30-12 months house loan prices, reflects the quality investors count on for getting on the further threat concerned in home loan lending.

Going back to 2017, the unfold concerning 10-calendar year Treasurys yields and 30-year fastened-rate mortgages has averaged about 2.05 share factors.

During that time, the spread has ranged from a substantial of 2.93 proportion factors in April 2020 — as the pandemic was just having underway — to a very low of 1.47 percentage points in May 2021, as a housing increase pushed by small interest costs and sparse inventory raged.

The unfold involving 10-year Treasury yields and house loan prices has been increasing considering the fact that then, and is virtually as broad as it was at the outset of the pandemic.

Though delinquencies and defaults on household financial loans are still minimal by historic requirements, investors in home finance loan-backed securities are fearful about a thing else: prepayment possibility.

If the Fed’s attempts to beat inflation lead to a economic downturn, curiosity charges are most likely to appear back again down, providing lots of house owners having out financial loans now the option to refinance at a decrease fee.

Zandi estimates that the spread is 4 “standard deviations more substantial than common,” largely for the reason that massive swings in prices enhance the prepayment danger borne by traders.

“Rate volatility will not normalize, and therefore the unfold slim and fees tumble right up until the Fed is accomplished mountaineering rates,” Zandi predicted. “But which is not for a when.”

In their most recent forecast, Fannie Mae economists abandoned preceding projections for a dramatic retrenchment in premiums subsequent calendar year.

Premiums not expected to simplicity

Resource: Fannie Mae Housing Forecast.

In August, Fannie Mae forecasters have been predicting that 30-calendar year fastened-price mortgages had previously peaked at 5.2 percent throughout the 2nd quarter and would retreat to an ordinary of 4.4 p.c during the next fifty percent of 2023.

But in their September forecast, Fannie Mae economists warn that the Fed is still seeking to get inflation underneath command. Even with a possible recession on the horizon, forecasters at the mortgage loan giant see rates peaking at 5.7 percent, and coming down only a bit to 5.5 per cent by the conclusion of up coming yr.

Revenue of new homes are a “fairly reputable economic downturn warning,” Moody’s economists claimed in the weekly market place outlook. If the 6-thirty day period centered transferring typical of new property gross sales falls by 20 p.c to 30 p.c, a economic downturn typically follows.

The six-month centered common of new household income is down 19.6 % from a yr back, and “odds favor additional weakening as home finance loan prices will most likely proceed to improve.”

The current pandemic-pushed company cycle is “unlike any other … so it is vital not to depend on a solitary warning of a recession. But declines in housing activity may possibly be an ominous signal,” Moody’s Analysts concluded.

Get Inman’s More Credit Publication delivered suitable to your inbox. A weekly roundup of all the greatest news in the environment of mortgages and closings delivered every Wednesday. Simply click right here to subscribe.

Email Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?