A comparison of Zillow Offers and Opendoor highlights the critical importance of pricing in iBuying. There’s an understated elegance in the detail; it’s not just buying low and selling high. But what makes for a successful pricing operation?

This post has been republished with permission from Mike DelPrete.

A catastrophic pricing failure sunk Zillow’s iBuyer business. Clearly, home price appreciation is a key factor of the housing market in 2021 and beyond. And being able to accurately predict house prices — not only today, but into the future — is a non-negotiable prerequisite for iBuyers.

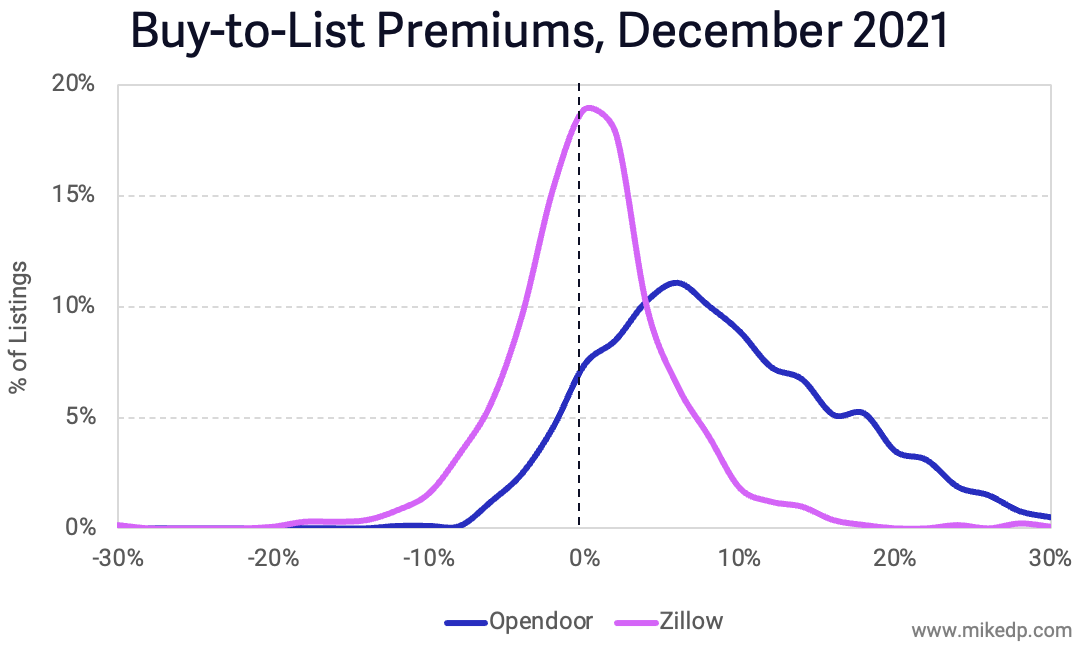

The best leading indicator of effective and accurate pricing is the buy-to-list premium; the difference between the purchase price and current listing price of a home. Unlike Opendoor, Zillow overpaid for the homes it acquired and is selling them for a loss — a negative buy-to-list premium, and a big problem.

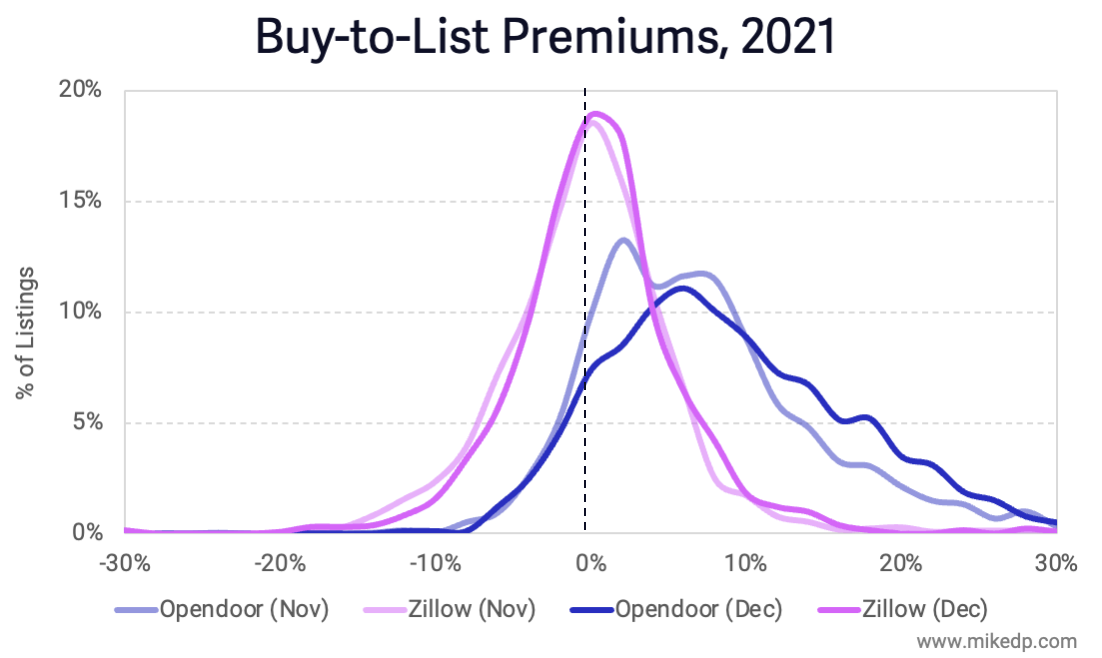

Opendoor’s median buy-to-list premium is rising once again, a sign of a healthy pricing and resale operation that is successfully reading the market.

While Opendoor’s median buy-to-list premium is higher than Zillow’s, the magic is in the distribution curve. Opendoor has a wide distribution of premiums that skews higher, leading to higher gross profits.

The finesse of Opendoor’s pricing curve has been refined and improved over the past month. Not only has its median buy-to-list premium increased, but the percentage of listings with higher premiums has increased; the curve has shifted to the right.

A matter of timing

The buy-to-list premium is a leading indicator and a predictor of what is to come. The price a home sells for (buy-to-sale) is typically, but not always, a few percentage points lower than the listing price.

Even though Opendoor’s buy-to-list premium is rising in Q4, its home price appreciation will be quite low for the quarter due to the intense pricing pressure of the previous quarter.

Strategic implications

A comparison of Zillow Offers and Opendoor highlights the critical importance of pricing in iBuying. There’s an understated elegance in the detail; it’s not just buying low and selling high. A successful pricing operation — not just an algorithm, but people! — needs to work at scale, needs to improve over time, and needs to be more nuanced than a brute-force bell curve.

As the Zillow Offers collapse has demonstrated, pricing is a true potential competitive advantage for iBuyers. Getting it right is a prerequisite for success, while getting it wrong can lead to catastrophic failures.

Mike DelPrete is a strategic adviser and global expert in real estate tech, including Zavvie, an iBuyer offer aggregator. Connect with him on LinkedIn.

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?