Median residence sale costs exceed the residence-purchasing ability of would-be customers in 19 of 50 marketplaces, according to knowledge introduced Tuesday by Very first American Economical Corp.

Sign up for industry visionaries Pete Flint, Spencer Rascoff, Ryan Serhant and far more at Inman Link New York, Jan. 24-26. Punch your ticket to the future by joining the smartest people in real estate at this ought to-go to celebration. Register listed here.

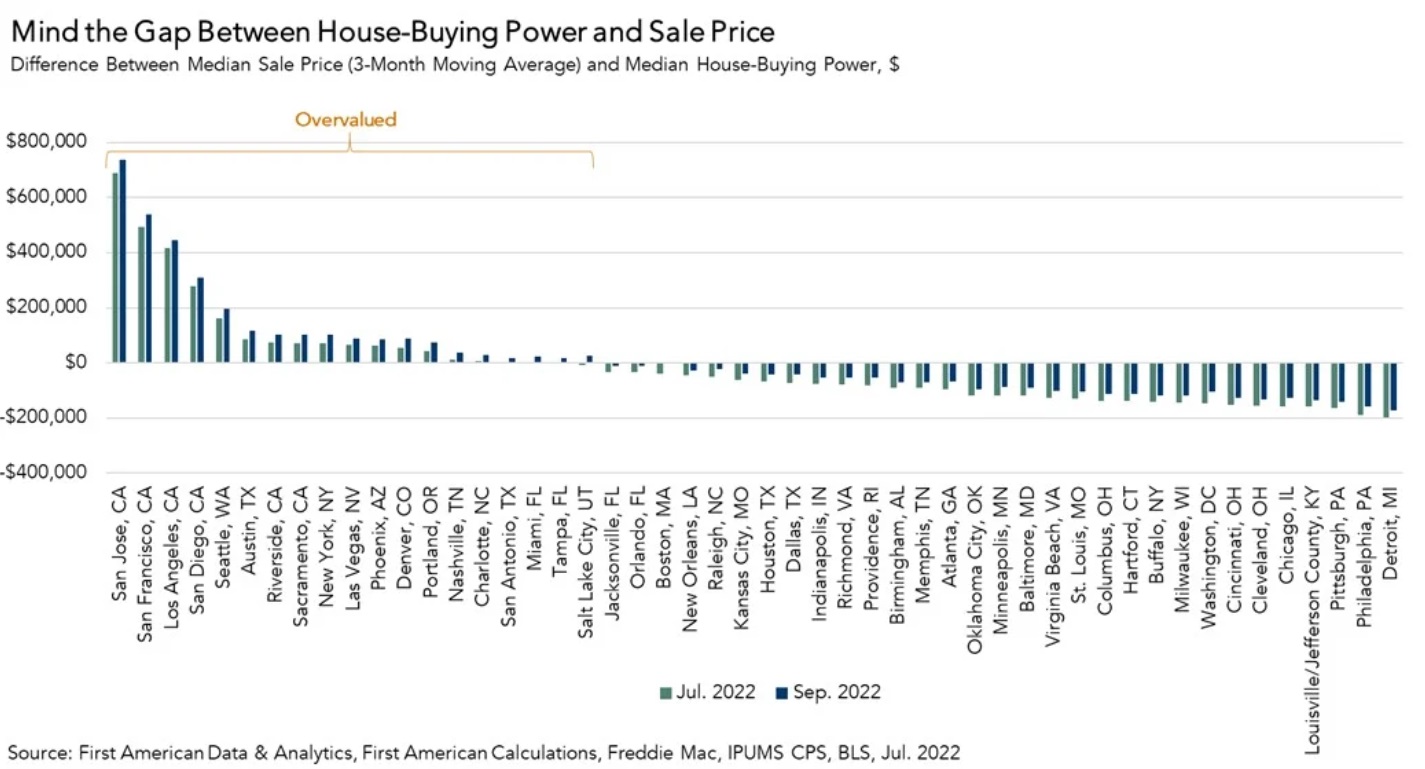

The amount of overpriced housing marketplaces has far more than quadrupled in the past 12 months, as the one-two punch of mounting mortgage fees and house selling prices has pushed “real” dwelling selling prices up by extra than 50 percent above that time.

That is according to the most recent Initial American Authentic Dwelling Price tag Index (RHPI), which measures rate adjustments of single-family members attributes soon after modifying for the effect of improvements in family earnings and curiosity charge modifications.

At this time a calendar year in the past, First American’s index proposed properties have been overvalued in just four of the 50 greatest U.S. markets, all in California: San Jose, San Francisco, Los Angeles and San Diego.

But with boosts in residence price ranges and home finance loan prices given that then, median sale rates exceed the household-getting electricity of would-be purchasers in 19 of 50 markets, 1st American Money Corp. declared Tuesday.

Mark Fleming

“For dwelling consumers, there are couple choices to mitigate the reduction of affordability induced by a greater home loan charge and growing costs,” mentioned 1st American Chief Economist Mark Fleming, in a assertion.

Increasing domestic money has improved home-acquiring energy some, but not by sufficient to offset all of the impact of better mortgage fees and house prices on affordability, Fleming claimed.

6 of the eight most overvalued markets identified by the index are in California. Two other states also experienced additional than a person overvalued marketplace — Florida (Miami and Tampa) and Texas (Austin and San Antonio).

Most overvalued markets

- San Jose

- San Francisco

- Los Angeles

- San Diego

- Seattle

- Austin

- Riverside

- Sacramento

- New York

- Las Vegas

- Phoenix

- Denver

- Portland, Oregon

- Nashville

- Charlotte, North Carolina

- San Antonio

- Miami

- Tampa

- Salt Lake Metropolis

At $770,000, median house-acquiring power in San Jose in July was scarcely a lot more than 50 percent of the median sale cost of a house at $1.46 million, Fleming noted in a weblog article. That’s encouraging awesome annual household value appreciation in the San Jose market place, which Very first American calculates peaked at 19.4 per cent in February in advance of slowing to 4.6 % in July.

“As affordability wanes, would-be prospective buyers are pulling again from the industry, prompting yearly home price tag appreciation to moderate,” Fleming said.

That conclusion is backed up by two other household-cost indexes unveiled Tuesday — S&P CoreLogic’s Situation-Shiller report, and an index compiled by Fannie Mae and Freddie Mac’s regulator, the Federal Housing Finance Company. Individuals indexes exhibit countrywide dwelling selling prices peaking nationwide in June and then dropping on a seasonally altered foundation in July.

Regardless of the squeeze on affordability in numerous marketplaces, Initially American’s index suggests that household purchasing electric power still exceeds the median sale price tag in 31 marketplaces. In Detroit, Philadelphia, and Pittsburgh, houses are regarded undervalued by approximately $200,000.

“While the markets considered overvalued could have to have to modify to the not-so-new truth of bigger mortgage fees, housing market place fundamentals even now guidance a moderation of annualized house selling price appreciation relatively than a sharp drop,” Fleming reported.

Get Inman’s Further Credit history E-newsletter delivered right to your inbox. A weekly roundup of all the biggest information in the entire world of home loans and closings delivered just about every Wednesday. Simply click right here to subscribe.

Electronic mail Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?