After breaking records for days on market, mortgage rates, median sales price and inventory in 2021, the housing market won’t burn quite as hot in 2022, but will still scorch as a multitude of buyers chase too few homes, according to economic experts across the real estate industry.

In general, experts predict home prices to continue to rise — albeit more slowly than this year’s white-hot rate — while mortgage interest rates increase and inventory bumps up marginally from a record low. Pandemic-fueled inflation is expected to decelerate and worker flexibility will continue to pull homebuyers to more affordable areas.

“The forecast for the 2022 housing market isn’t looking too different from 2021,” said Kate Wood, home and mortgage expert at NerdWallet, in a statement. “If the market is cooling down, it’s only by a few degrees. There are still many more buyers than there are homes for sale, particularly in the ‘starter home’ price tiers. Sellers continue to have the upper hand, but as buyers go from weary to exasperated, in some markets the days of bidding wars and no-contingency sales may start to wane.”

Next year will see a more balanced market with a bit more inventory and slower price growth, but it certainly won’t be a buyer’s market, according to Redfin’s chief economist Daryl Fairweather.

Daryl Fairweather

“We will see a rush to buy homes at the start of the year before mortgage rates rise,” she said. “That early onslaught of demand will deplete the supply of homes for sale. In the second half of the year, a much needed increase in new construction will boost sales slightly. In 2022, there will be 1 percent more sales than in 2021, and by the end of the year, home price growth will slow to 3 percent.”

Homebuyers should expect a “whirlwind year” in 2022, realtor.com economists said in their 2022 forecast.

“Americans will have a better chance to find a home in 2022, but will face a competitive seller’s market as first-time buyer demand outmatches the inventory recovery,” they said.

“Additionally, with listing prices, rents and mortgage rates all expected to climb while incomes rise, 2022 will present a mixed bag of housing affordability challenges and opportunities.

“With more sellers expected to enter the market as buyer competition remains fierce, we anticipate strong home sales growth. Affordability will increasingly be a challenge as interest rates and prices rise, but remote work may expand search areas and enable younger buyers to find their first homes sooner than they might have otherwise.”

Here are five economic indicators to keep an eye on next year.

Mortgage rates

The Federal Reserve has caused a recent stir by announcing it will double the pace of its tapering of support for mortgage markets, as falling unemployment and worries about inflation outweigh uncertainty around the potential health and economic impacts of the Omicron coronavirus variant.

The Fed had planned to trim the $120 billion in monthly asset purchases it’s been making during the pandemic to keep interest rates low by $15 billion a month, but recently voted unanimously to double the pace of tapering, to $30 billion a month — a timetable that would end the Fed’s asset purchases in March.

After release of the Federal Open Market Committee’s statement, 10-year Treasury yields surged, as markets digested the Fed’s plans speed up its exit from bond markets — an event that would normally put downward pressure on mortgage rates. But the next day, yields dropped sharply.

The Fed’s quarterly Summary of Economic Projections shows most policymakers on the committee are expecting three 0.25 percentage point increases in the short-term federal funds rate next year, which National Association of Realtors Chief Economist Lawrence Yun said would mean rising mortgage rates. He expects the 30-year fixed mortgage rate to increase to 3.5 percent as the Fed raises interest rates to control inflation, which he noted is lower than the pre-pandemic rate of 4 percent.

Lawrence Yun | Photo credit: NAR

Prices for U.S. consumer goods are up 6.8 percent over the last year — the fastest increase in any 12-month period since 1982, according to Consumer Price Index numbers. Yun expects inflation to moderate in 2022, to 4 percent, and expects GDP to “grow at the typical historical pace of 2.5 percent, barring any major, widespread transmission of the omicron COVID-19 variant.”

Redfin’s Fairweather predicts 30-year-fixed mortgage rates to rise from around 3 percent to around 3.6 percent by the end of 2022, translating into about $100 more per month in mortgage payments for the median home.

The anticipated change in mortgage rates may push some sellers off the fence, according to Bank of America.

“With mortgage rates at historic lows, some homeowners will want to trade up to larger homes,” the lender told Inman in a statement. “As the Federal Reserve will be tapering mortgage-backed securities due to rising inflation, those already in the position to look into larger homes will aim to tap into lower rates while they can.”

Home sales

Economists from Zillow and realtor.com predict that existing-home sales will hit 16-year highs in 2022.

“Existing home sales are predicted to total 6.35 million, compared to an estimated 6.12 million this year,” Zillow‘s 2022 forecast predicts. “That would be the highest number of home sales in any year since 2006.”

Realtor.com anticipates a 6.6 percent rise in home sales next year.

“With more than 45 million millennials in the prime first-time homebuying ages of 26 to 35 in 2022, demand for housing is expected to remain strong,” the portal’s forecast reads. “A growing economy and declining unemployment … also propels income growth of 3.3 percent by the end of the year, keeping sales levels high despite climbing mortgage interest rates.

“In most metro markets, our model suggests that home sales will follow the national trend and increase in 2022. While some markets are expected to see home sales declines, these declines are likely to be modest. In fact, for many areas forecasted to see declines, 2022 is expected to have the 2nd highest sales level in the last 15 years, bested only by 2021.”

By contrast, NAR’s Yun expects a slight dip in home sales due to rising mortgage rates.

“The housing market performed better than it has in 15 years in 2021, with an estimated 6 million existing-home sales,” NAR said in a press release. “As mortgage rates tick up slightly, Yun predicts existing-home sales will decline to 5.9 million in 2022. ”

Inventory

If there’s one factor in the housing market that is outweighing everything else, inventory may be it.

Pierre Debbas

“2021 was arguably the best year in history for the housing market,” said Pierre Debbas, managing partner of leading real estate law firm Romer Debbas LLP, in a statement. “We are going into 2022 with close to a shortage of 6 million homes to match current demand levels.

“Even as would be first time home buyers are priced out of the market, investors are scooping up single-family homes at a record pace and short of a collapse in the economy and a very significant rise in interest rates, the housing market should continue to thrive in this new normal that has been created by the pandemic.”

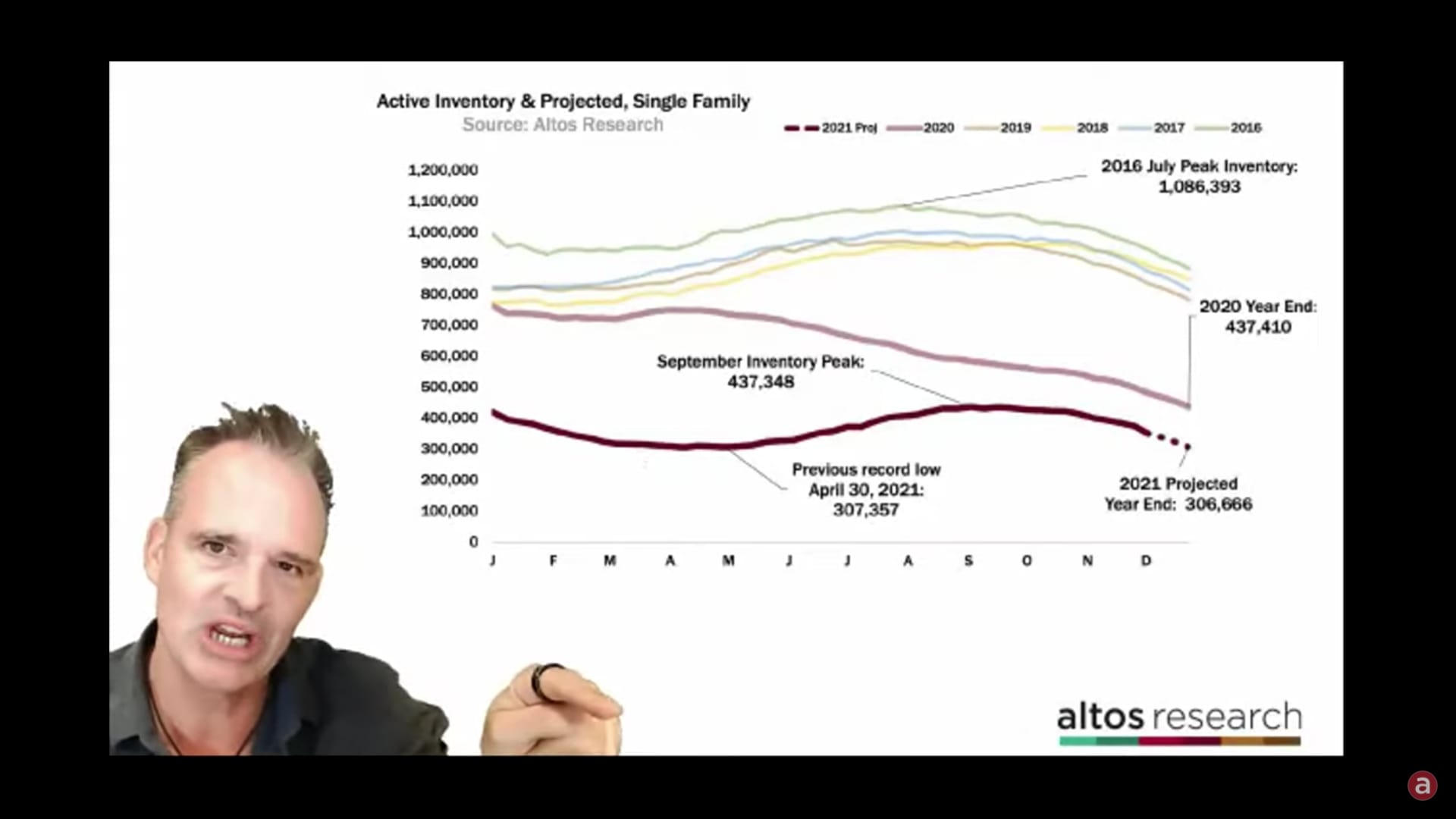

Active, for-sale inventory of single-family homes typically hits bottom in the second week of January, but it didn’t reach that point until April 30 in 2021, according to Mike Simonsen, co-founder and CEO of Altos Research.

“Any new inventory that was getting listed in the first quarter was getting gobbled up so quickly that inventory actually kept falling,” he said in his “Real Estate Market Outlook for 2022” webinar. “We’re about to break that record low.”

Mike Simonsen, Altos Research

“It’s going to be very difficult for us to have anywhere near the normal levels of inventory for 2022,” he added. “What that means is we can already see in the data that supply is restricted for all of the whole year.”

Even if mortgage rates were to rise, inventory would only increase “a little bit,” according to Simonsen.

“No matter what happens with rates, with the rest of market, there’s very little opportunity for a lot of inventory to build,” he said.

That is due to both skyrocketing demand and suboptimal levels of homebuilding, according to experts.

“The market forces that have given sellers the upper hand over the past two years or so — tight supply after years of underbuilding, and elevated demand due to remote work, U.S. demographics and low mortgage rates — will persist next year as well,” Zillow economists said. “Expect to see bidding wars on many homes, especially as the market heats up during the spring and summer shopping season.”

Regarding demand, Bank of America notes that millennials are leading the homebuying charge and they are nowhere near done reaching the prime age for homebuying.

“As rent prices have sped past projected estimates based on pre-pandemic trends, homeownership and steady monthly mortgage payments become more attractive,” the lender told Inman in a statement.

“This will continue to be the case for millennial buyers in the coming years, as the tailwind from this generation of homebuyers is still in the early stages. The number of 35-44 year olds (historically a leading indicator of housing starts) is set to increase by 5 million over the next eight years.”

While many potential sellers are sitting on the sidelines — in part because buying in this market is so daunting — many are taking the plunge; realtor.com expects inventory to grow 0.3 percent on average next year.

But it still won’t be enough. Redfin’s Fairweather predicts new listings will hit a 10-year high in 2022, but that will “hardly make a dent in the ongoing supply shortage.”

“In 2022, new listings will surpass the 2018 high of 7.6 million homes, setting a new record going back to at least 2012,” Fairweather said. “As the market becomes more balanced, homeowners will find it less daunting to list their home while looking for a new one to buy. Home-sale contingencies, which allow a homeowner to make an offer to buy a new home on the condition that their existing home sells first, will become more common.

“The end of double-digit price growth will also encourage more homeowners to finally cash-out. This increase in listings of existing homes will coincide with a slight increase in listings of newly constructed homes.”

According to Census Bureau figures, housing starts jumped 11.8 percent in November to a seasonally adjusted annual rate of 1.68 million units — the fastest pace since March. Single-family units rose 11.3 percent.

Fannie Mae is predicting that single-family housing starts in 2021 will add up to 1.125 million and rise to 1.179 million in 2022 — a 4.8 percent increase but a difference of only 54,000 homes.

Doug Duncan | Photo credit: Fannie Mae

“Demand for new home construction remains robust as the supply of existing homes for sale remains historically tight and mortgage rates continue to be highly supportive for homebuyers despite drifting upwards recently,” Doug Duncan, Fannie Mae’s chief economist said in a statement.

“However, supply bottlenecks and labor scarcity continue to hold back a faster pace of construction. Despite the rise in starts, single-family home completions were essentially unchanged over the month, while the number of units under construction rose by 2.9 percent to the highest level since early 2007. Eventually these homes will add to the overall housing supply, but today’s report showed little evidence of improvement regarding homebuilders’ ongoing struggle to keep up with demand.

“More recently too, lumber prices are surging again, jumping around 80 percent over the last month as measured by futures contracts, after easing for much of the year. This suggests ongoing cost pressures are far from abating and that the degree at which starts can continue to increase in the near term is limited.”

The expected increase in new construction will be “a drop in the bucket,” according to Zillow economists.

“Zillow research shows that in the 35 largest housing markets alone, there has been a shortfall of 1.35 million new homes since 2008 because of a construction slowdown following the housing crash,” they said.

“Homebuilder confidence is sky-high, and builders are doing all they can to get houses up, but supply chain snags and labor shortages are limiting progress. The gap shrunk in 2021 and will likely shrink again in 2022, but the housing shortage will be a defining feature of the market once again next year.”

Home prices

That lack of supply will inevitably lead to higher home prices, though they won’t rise as much as they did this year. Economists differ on exactly how much of a bump they’ll get, however.

After rising 17.6 percent in 2021, Fannie Mae predicts that the median price of an existing home will rise 11.5 percent in 2022, to $387,000. Zillow’s economists anticipate home values will rise 11 percent in 2022, down from an expected record 19.5 percent rise in 2021.

“2022 will fall just short of record-breaking,” Zillow said. “2021 marked the hottest housing market in U.S. history by some measures, including Zillow’s Home Value Index. While we may not see those records broken in 2022, Zillow economists expect incredibly strong price growth and sales volume to continue.”

This will be in part due to rising rents, which Redfin expects will increase by 7 percent by the end of 2022, more than double the 3 percent annual increase the brokerage expects for home prices.

Taylor Marr

“Millions of millennial renters are on the cusp of buying their first home, but we expect many will still be held back from homeownership due to affordability,” said Redfin Deputy Chief Economist Taylor Marr in a statement.

“Home prices will remain at record highs requiring hefty down payments at the same time rising mortgage rates will make home buying more expensive, so many potential first-time homebuyers will choose to keep renting.”

Realtor.com’s economists similarly expect a 2.9 percent increase in home prices in 2022.

“The pandemic ignited a frenzy in the housing market,” they said. “A decade’s long shortage which meant the market was already 5.2 million single-family homes short was met with an unprecedented surge in demand just as many were expecting the opposite response to the pandemic uncertainty. While builders worked to adjust, the market balanced high demand and short supply by pushing prices higher. August 2020 kicked off a year-long streak of double-digit home price growth.

“Looking ahead, with economic growth expected to sustain the purchasing power of eager homebuyers, we expect the median home sales price to continue to increase, rising 2.9 percent in 2022, a notably more moderate pace. As builders ramp up production to meet demand, homebuyers will grapple with higher monthly costs due to rising prices and rising mortgage rates. Affordability challenges will keep prices from advancing at the same pace we saw in 2021 even as ongoing supply-demand dynamics mean prices continue to grow nationwide.”

Meanwhile, a National Association of Realtors survey of more than 20 top U.S. economic and housing experts landed at an expected annual median home price increase of 5.7 percent.

“Overall, survey participants believe we’ll see the housing market and broader economy normalize next year,” Yun said.

COVID impacts on worker mobility

As the Omicron variant rages and white-collar workers continue to have flexibility in where they work, more affordable cities and suburbs will attract more buyers, experts predict.

“Many companies shifted to remote work during the pandemic out of necessity, and this period has demonstrated that work is possible in a remote environment,” realtor.com economists said.

“Additionally, surveys show that many workers prefer working remotely, at least several days per week. Even as many companies are calling workers back to offices, others have shifted in the opposite direction, granting workers ongoing flexibility to work remotely. ”

The portal expects the suburbs to keep the attraction they gained at the beginning of the pandemic as they offered more space for less.

“With average commute times growing and nearly 20 percent of recent homebuyers reporting one-way commute times in excess of an hour, regular remote work enables homebuyers to broaden their search parameters or in some cases pick-up and relocate to a city where homes are more affordable, as many have done in the last year,” realtor.com said.

Experts differ on where those buyers will choose to put down roots. Zillow is betting on continued interest in the Sun Belt, though the company expects smaller, more affordable cities in the region to catch buyers’ attention.

“From April to August, Austin held the top spot in quarter-over-quarter home value growth, which is a good indicator of current housing demand,” Zillow said. “As of October, the smaller Florida metros of Fort Myers and Sarasota held the top spots, and 24 of the top 25 markets were in sunny states — a sign of things to come in 2022.”

“Zillow economists expect fully remote workers to continue to seek affordable markets, like those in the Sun Belt and other nontraditional housing hot spots where they can afford to buy their first home or trade up for a bigger one,” they added. “And amid the ‘Great Resignation’ and a generally aging population, traditional retirement markets are likely to see elevated demand.”

But Redfin’s Fairweather predicts that homebuyers will relocate to affordable cities like Columbus, Ohio; Indianapolis; and Harrisburg, Pennsylvania — where the median home price is still less than $250,000 — over the Sun Belt.

“Austin, Atlanta and Phoenix have seen home prices increase by 29 percent, 24 percent and 35 percent respectively since the start of the pandemic, making them less attractive to homebuyers that prioritize affordability,” she said. “The seasonally adjusted median Austin home price is now $462,000, which is above the national median of $376,000. The median home price is $330,000 in Atlanta and $416,000 in Phoenix.”

“Columbus, Indianapolis, and Harrisburg have all seen the number of homebuyers moving in minus the number moving out more than double since last year,” she added. “Meanwhile, Atlanta, Austin and Phoenix have seen a decline in net-migration since peaking in Q1 2021.”

At the same time, the worker flexibility brought by the pandemic will mean buyers have more leeway to choose where they want to live based not just on a home’s price, but on their political values, according to Redfin.

“After the Supreme Court decides contentious cases related to abortion rights and gun rights, we will see more migration for political reasons,” the brokerage predicted. “A recent Redfin survey confirms that a substantial share of homebuyers won’t move to a place where the laws conflict with their political beliefs. For example, 1 in 7 recent movers surveyed said they would refuse to live in a place where abortion is fully legal.

“Now that workers have more control over where they live, more people will seek out areas where there are like minded people with laws that fit their political beliefs. People who prefer to live in areas without mask and vaccine mandates will leave cities like New York and Los Angeles. People who are against voter-ID laws will move to places where voting is more accessible. People who are pro-choice will avoid states with restrictive abortion laws.

“We will also see more blue enclaves grow within red areas and vice versa, as parents select school districts that align with their preferences regarding mask mandates, critical race theory and other controversial issues.”

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?