Be part of us at Inman Hook up New York this January for 75+ instructional classes, 50+ qualified speakers, and networking alternatives with hundreds of field pros. Sign-up now for our Labor Day specific price good as a result of September 5! Test out these just announced speakers for this must-go to occasion. Register right here.

Investments that mortgage loan loan companies have made in engineering and schooling to streamline the application course of action appear to be to be spending off in higher borrower fulfillment scores, but there’s area for advancement when it will come to document assortment and closings.

Which is the major takeaway from surveys of much more than 7,000 debtors by property finance loan marketplace advisory company STRATMOR Team and tech service provider Snapdocs.

The surveys of debtors who have taken out home loans in the previous nine months identified that though only one particular in 5 borrowers encountered an issue, the preclosing and closing course of action accounted for 70 % of over-all borrower gratification.

While rising mortgage loan rates have compelled many loan companies to downsize this yr, other folks have been using engineering and area ties to develop their nationwide footprints. Atlanta-centered direct mortgage financial institution Silverton Home finance loan, a Snapdocs customer, has extra new branches in the Carolinas, Arkansas and Missouri around the earlier 12 months.

Garth Graham

“Lenders need to have to uncover new ways to contend for business in this sector,” said STRATMOR Group’s Garth Graham in a statement. “While just one verified tactic is to make a best-in-class borrower experience, there’s no consensus on what ‘best-in-class’ implies, substantially considerably less how to evaluate it. This exploration delivers a granular view into the critical ‘moments that matter’ so that loan providers can get started to construct their CX tactics about empirical facts.”

“Over the past decade, loan providers have labored to minimize difficulties with the application method, and the examine results affirm this,” researchers claimed in a report posted Tuesday documenting their results.

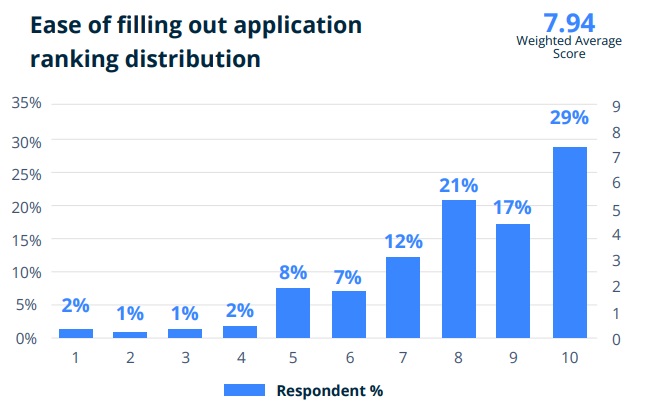

Source: “The State of Borrower Knowledge,” STRATMOR Group

About two-thirds of borrowers (67 p.c) claimed filling out the mortgage loan software was fairly simple, rating the simplicity at an eight or over on a 10-place scale.

Even though 42 p.c of borrowers explained they wanted support filling out their mortgage application, people who did check with for assistance were being a bit additional possible to advocate the loan provider, suggesting personal involvement from the bank loan officer generates a superior experience, the report concluded.

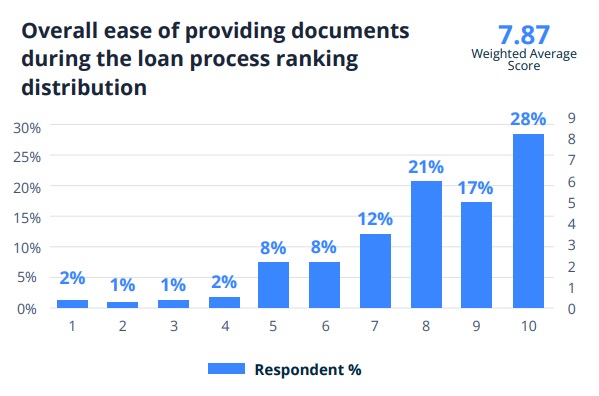

Resource: “The Condition of Borrower Encounter,” STRATMOR Team

Though most debtors also identified offering documents to be fairly effortless, they ended up much less probable to endorse loan providers who produced what they deemed to be unreasonable doc requests.

Although only 9 % of debtors encountered what they considered to be unreasonable document requests that practical experience had a enormous influence on their “Net Promoter Score” (NPS) — a measurement of purchaser loyalty on a scale of -100 to 100, centered on how likely a client is to recommend a product or service or provider they’ve utilized.

The NPS for borrowers who said they been given unreasonable document requests dropped by 70 factors on ordinary, whilst 36 % of debtors said they experienced recurring requests for files they presently furnished, which prompted an 11-stage fall in their NPS.

Loan providers typically will need to ask for paperwork extra than at the time, because a borrower’s situation can modify after they’re preapproved or fill out an application. A job alter or gift, for example, may possibly aid a borrower get greater personal loan terms.

The require for up-to-date documents is not a trouble that’s quickly dealt with by know-how, but loan companies can offer far more transparency about the system to debtors so they’re not shocked by this kind of requests, the report explained.

“If lenders make document assortment an productive, perfectly-communicated system for each individual borrower, they can substantially strengthen the borrower’s practical experience,” the report said.

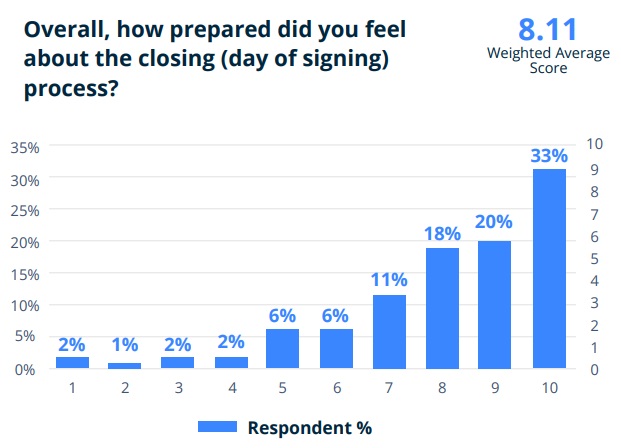

Supply: “The Condition of Borrower Working experience,” STRATMOR Group

Though 71 % of debtors rated their preparedness for closing an eight or above on a 10-position scale, the subset of debtors that did not really feel ready had “a important harming impact” on the lender’s NPS.

If debtors claimed they weren’t presented an option to preview their closing files, the NPS dropped by 33 points. The scores dropped by an average of 55 details when debtors felt they weren’t offered enough time to preview their closing paperwork.

Approximately four out of 10 debtors (38 p.c) explained there ended up surprises at the closing desk, this sort of as lacking or inaccurate paperwork or an interest amount or charges they weren’t anticipating.

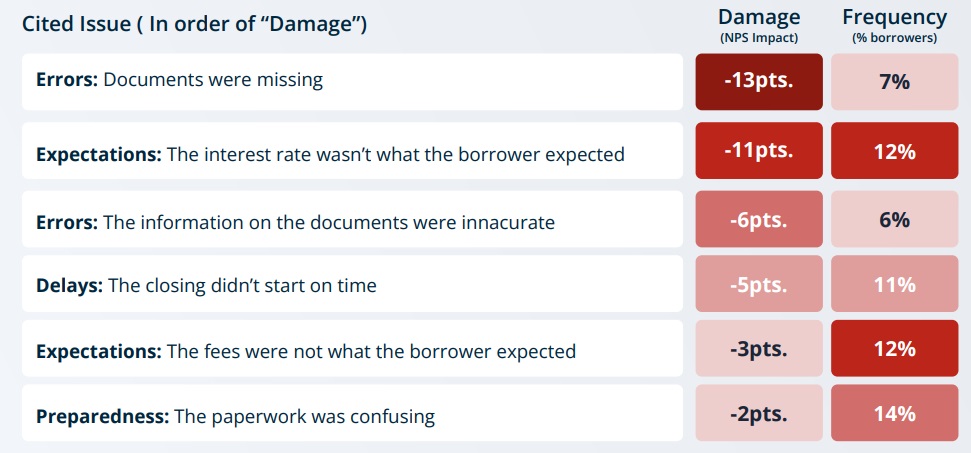

Resource: “The Point out of Borrower Experience,” STRATMOR Group

Amongst debtors who professional problems at the closing desk, NPS dropped by 34 factors, on regular, with missing documents resulting in the most problems to NPS (-13 factors), adopted by an unforeseen home loan fee (-11 factors) and inaccurate info on paperwork (-6 points).

With the closing section getting the greatest affect on all round borrower satisfaction, loan companies “have the most option to boost the borrower knowledge in the preclosing and closing phases of the financial loan journey, and may be equipped to notice a more quickly return on investment decision with technological innovation,” the report concluded.

In accordance to STRATMOR Team info, just beneath half of loan companies have previously applied digital closing and closing collaboration know-how.

When loan providers give debtors the capacity to preview paperwork, “they could be better well prepared for the closing and capture any unresolved mistakes,” the report said. “Additionally, digital closing and closing collaboration applications deliver creditors the skill to agenda the closing appointment and quickly route paperwork, therefore cutting down delays, and may perhaps even automate [quality control] procedures to even more decrease problems.”

Snapdocs and STRATMOR are offering free of charge diagnostic assessments “to aid lenders comprehend how they rank versus these field benchmarks and produce custom made methods to enhance their borrower knowledge.”

Get Inman’s Excess Credit rating Publication shipped correct to your inbox. A weekly roundup of all the biggest information in the earth of home loans and closings shipped each individual Wednesday. Click in this article to subscribe.

E-mail Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?