House buys are anticipated to plummet further in the closing months of the 12 months, and the recovery may well not select up velocity until 2024, in accordance to a new forecast from the expense financial institution.

Be a part of us at Inman Join New York this January for 75+ academic classes, 50+ skilled speakers, and networking chances with countless numbers of business industry experts. Sign up currently for our Labor Working day distinctive charge great by way of September 5! Verify out these just announced speakers for this should-go to occasion. Sign-up listed here.

Actual estate brokers whose small business has taken a hit in modern months may possibly need to have to cling on more time, as forecasters at just one giant investment decision lender say the product sales atmosphere is possible to get even worse just before it will get superior.

A new paper introduced this 7 days by Goldman Sachs predicts home revenue will drop to a seasonally altered once-a-year rate of 4.7 million in the fourth quarter of the year. These levels, if they bear out, would symbolize a different fall of 12 p.c from July’s revenue rate even following the steep declines that have presently occurred, and suggest the marketplace has however to hit base.

“The outlook for demand continues to reward from a restricted labor sector and a ongoing demographic tailwind from millennials passing as a result of their key home-purchasing decades,” the report reads. “However, the sustained reduction in affordability, waning pandemic tailwind, and new drop in acquiring intentions … suggest that residence gross sales are probable to slide further by means of yr-finish.”

To add insult to damage, the financial investment banking huge expects residence income to recuperate only “modestly” in 2023, portending a comprehensive year of sales volume a lot more akin to what the housing current market saw in 2012 than in the bustling ten years considering the fact that.

Chart by Goldman Sachs

The envisioned drop in demand by means of the conclusion of the 12 months would be pushed nearly completely by the sector for existing residences, which would see product sales prices decrease by 12 % from July by way of the year’s closing months.

Profits of newly created properties, which have previously suffered large declines, would be unlikely to drop a great deal additional, in accordance to Goldman Sachs’ projections.

Goldman Sachs is not but signing up for the checklist of forecasters projecting a broad-centered decline in household rates, nonetheless.

While some dwelling-cost indexes are now looking at declines, ones that account for the modifying composition of profits — these kinds of as fewer properties selling in greater cost points — recommend that property values continue to increase, just at a slowing rate, the report states.

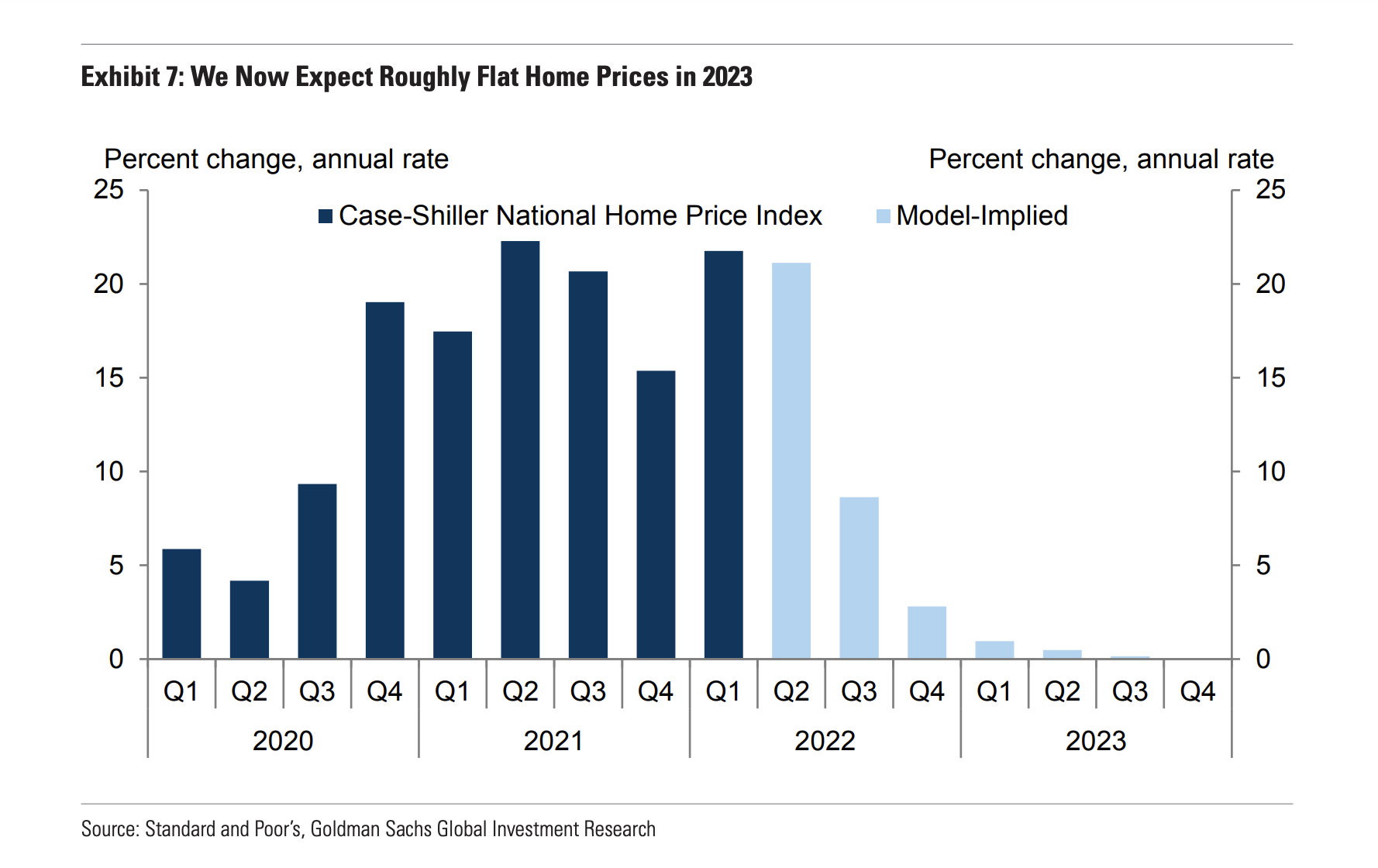

With that in intellect, the bank’s exploration crew expects value advancement to gradual to a charge of 14 p.c calendar year-above-12 months in the ultimate a few months of the 12 months, then “stall completely” from 2022 to 2023.

Chart by Goldman Sachs

These forecasts reflect worsening conditions, as Goldman Sachs was formerly a little bit additional bullish on house price tag growth.

The ongoing imbalance between offer and need has served to prop up the residence industry even amid climbing mortgage loan charges, the report suggests. That points out why transactions — and rates — have but to fall additional amid increasing affordability problems.

But particular resources of demand from customers distinctive to the pandemic show up to be disappearing much more swiftly than anticipated.

“Existing household profits and developing permits have fallen a lot more sharply this calendar year in areas where by they elevated the most in the previously component of the pandemic,” the report says, “suggesting that the recent declines have also mirrored the partial retreat of a pandemic-relevant increase to housing demand.”

These could consequence in price decreases in a variety of locations of the place, even if broad-dependent declines are a lot less probable, Goldman Sachs explained.

Electronic mail Daniel Houston

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?