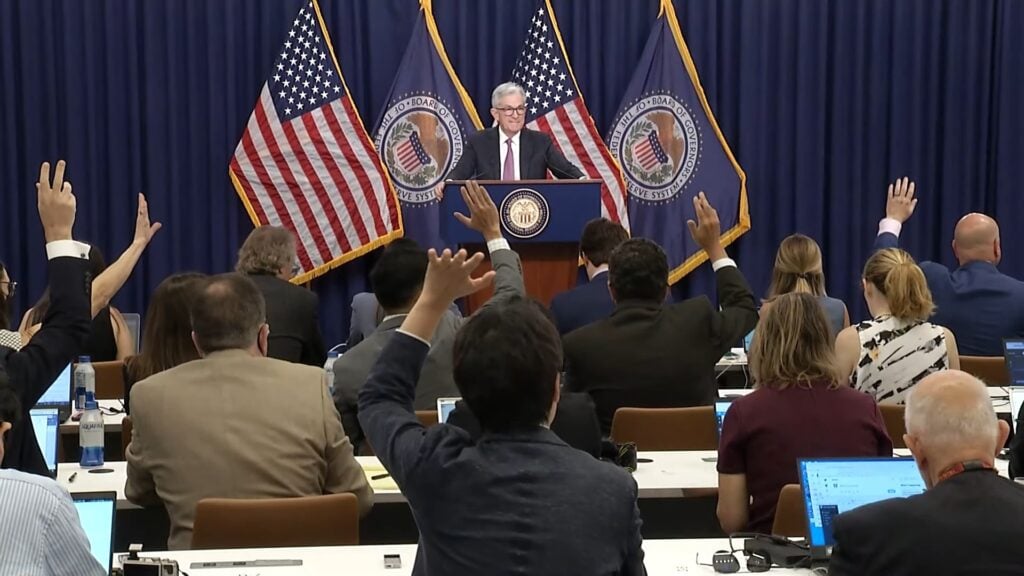

A stern warning from Federal Reserve Chair Jerome Powell that taming inflation “requires applying our instruments forcefully” even if that brings “some discomfort to homes and businesses” sent inventory prices tumbling Friday, but experienced astonishingly little impression on extended-phrase desire costs.

Powell’s remarks at the annual Jackson Gap central banking convention in Wyoming lifted the odds that the Fed will employ another 75 basis-point maximize in the quick-expression federal funds charge at its next assembly, which concludes Sept. 21.

But the Fed does not have these kinds of direct manage more than home loans and long-phrase fascination premiums, which stayed put Friday as bond marketplace traders stood business on bets that the Fed will have to have to pivot future year and commence reducing fascination prices if the financial state slows or enters a economic downturn.

Yields on 10-calendar year Treasury notes, which are helpful indicators of which way home finance loan prices are headed next, hovered close to 3 % right after Powell’s handle. About the past 12 months, yields on 10-12 months Treasurys have climbed from a small of 1.26 percent to a 2022 peak of 3.48 p.c on June 14.

Home loan premiums stabilize

The Best Blue Home loan Current market Indices show rates for 30-year set-charge conforming financial loans also hit their 2022 peak of 6.06 % on June 14. While extended-phrase premiums bounced back in August, mortgage loan field teams assume they’ve peaked and will ease next yr.

Home finance loan costs predicted to relieve

Resource: Fannie Mae Housing Forecast, August 2022

In a forecast issued this week, Fannie Mae economists acknowledged the chance that the Fed will continue to be aggressive in boosting small-expression desire charges if inflation and career development remain strong. But they foresee a lot less force on extended-phrase interest fees together with home loans, because of to anticipations that a “modest recession” is looming following yr and that the labor market place will soften as the effects of tighter monetary policy just take hold.

In a July forecast, economists at the Home loan Bankers Association predicted a identical, but significantly less pronounced pullback in property finance loan premiums.

But in his speech Friday, Powell appeared to be issuing a warning not to undervalue the Fed’s dedication to bring down inflation.

“The Fed seems discouraged by current market expectations — which we have never shared — of easing upcoming yr,” explained Pantheon Macroeconomics Chief Economist Ian Shepherdson in a note to shoppers.

“The Fed can not relieve until finally inflation is plainly headed again to focus on, and wage growth has slowed markedly,” Shepherdson wrote. “The Chair’s message currently is that the Fed thinks these conditions are not likely to be satisfied as quickly as marketplaces count on. We believe he is in all probability ideal.”

Shepherdson stated that though Powell acknowledged inflation has been driven by sturdy demand from customers and tight supply constraints, “He left unsaid the position which we have been earning for some time: Specifically, that restricted offer has facilitated a huge surge in margins, which likely will reverse, driving inflation down, now that inventories are returning to usual, or even previously mentioned regular.”

Powell hinted that a 75 basis-issue increase in the federal cash fee could be in the cards upcoming month, despite the fact that the final decision will count on the most up-to-date knowledge. A 3rd hike of that magnitude this 12 months would convey the limited-expression benchmark to concerning 3 percent and 3.25 %. In a June poll, users of the Federal Open up Market Committee indicated that they visualize elevating the federal funds rate to just below 4 percent and preserving it there through the conclude of upcoming calendar year to tame inflation.

“July’s improve in the goal assortment was the 2nd 75 basis-level increase in as many meetings, and I claimed then that yet another unusually huge enhance could be ideal at our following conference,” Powell claimed. “We are now about midway as a result of the intermeeting time period. Our determination at the September conference will count on the totality of the incoming knowledge and the evolving outlook. At some issue, as the stance of monetary coverage tightens more, it likely will grow to be acceptable to sluggish the speed of raises.”

The CME FedWatch Device, which screens futures contracts to estimate the chance of Fed rate hikes, displays traders on Friday have been pricing in a 60 percent probability of a 75-foundation position level hike on Sept. 21.

While the Federal Reserve has immediate manage more than the limited-term federal funds amount, fees on extended-term investments, these kinds of as Treasurys and mortgage loan-backed securities, rely mostly on investor demand.

The Fed is a person of all those investors, even so, acquiring amassed additional than $2.7 trillion in home finance loan financial debt to help maintain prices low through the pandemic and the “Great Recession” of 2007-09.

The Fed, which also retains $5.7 trillion in very long-phrase Treasurys, has been trimming its $9 trillion stability sheet this summer. In June, the Fed started its “quantitative tightening” plan by permitting up to $17.5 billion maturing house loan belongings roll off its guides every month.

Following thirty day period, the Fed is predicted to maximize the sizing of its property finance loan roll-offs, to $35 billion a thirty day period. The speed of Treasurys rolloffs is anticipated to be even faster — $30 billion a month at initial and rising to $60 billion a thirty day period just after 3 months.

The Fed’s $9 trillion harmony sheet

Belongings on the Federal Reserve’s stability sheet involve $5.70 trillion in very long-term Treasurys and $2.72 trillion in home loan-backed securities. Supply: Board of Governors of the Federal Reserve System, Federal Reserve Bank of St. Louis

Whilst Powell did not supply more perception on the rate at which the Fed intends to trim its equilibrium sheet, he did allude to the Fed’s intention to use its “tools” — highlighting that shorter-time period interest rates are not the only arrow in the central bank’s inflation-combating quiver.

“Restoring price tag security will consider some time and involves utilizing our applications forcefully to bring demand from customers and offer into greater harmony,” Powell claimed. “Reducing inflation is most likely to have to have a sustained period of down below-trend growth. Also, there will really probably be some softening of labor current market disorders.”

https://www.youtube.com/check out?v=vhMRynjm3CI

“While increased desire prices, slower progress, and softer labor current market ailments will deliver down inflation, they will also convey some soreness to households and businesses,” Powell said. “These are the unfortunate prices of reducing inflation. But a failure to restore price tag balance would mean significantly higher discomfort.”

Get Inman’s Excess Credit score E-newsletter sent ideal to your inbox. A weekly roundup of all the greatest news in the earth of mortgages and closings shipped each and every Wednesday. Click on here to subscribe.

Email Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?