The nonbank mortgage loan financial institution suggests 40-yr, curiosity-only financial loans will aid borrowers and traders who have been priced out of today’s housing industry.

Be part of us at Inman Hook up New York this January for 75+ academic periods, 250+ pro speakers, and networking possibilities with countless numbers of market industry experts. Sign-up right now for our Labor Day special fee fantastic by September 5! Look at out these just announced speakers for this have to-attend event. Sign up in this article.

Nonbank house loan loan company Newrez is heading back again to the playbook from the last housing growth, rolling out a 40-calendar year fixed-fee home loan it claims will help debtors and investors who have been priced out of today’s housing marketplace by delivering a decrease regular payment.

Like Newrez’s other “Smart Series” financial loan merchandise, the new 40-12 months mortgage is a “non-Qualified Home loan,” or non-QM, which means it’s not qualified for buy or promise by home loan giants Fannie Mae and Freddie Mac, so borrowers typically fork out bigger fees.

The new featuring is also an desire-only financial loan for the 1st 10 yrs, this means homebuyers who use it to finance a order won’t be demanded to pay down any financial loan principal for the 1st ten years they own their residences.

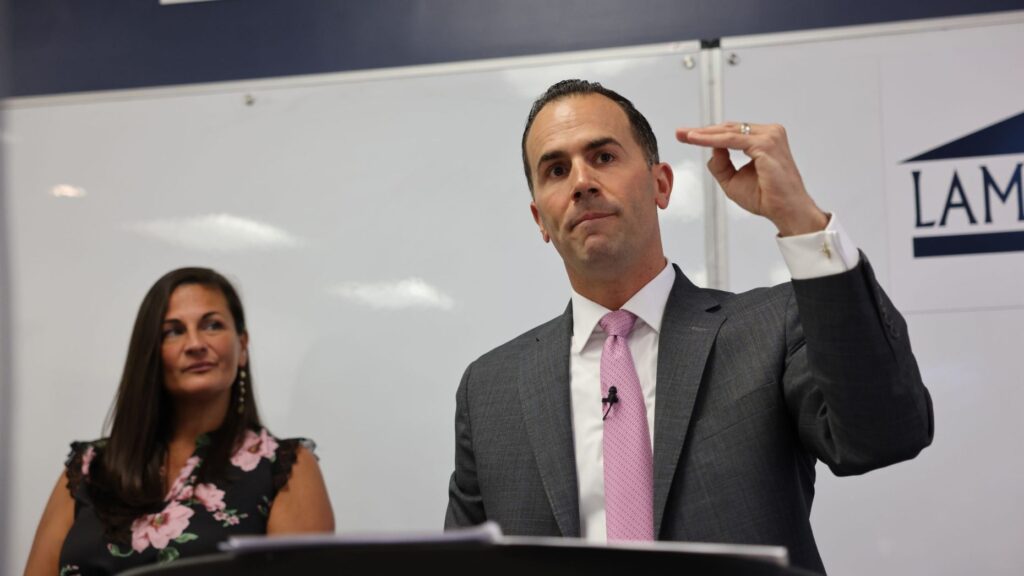

Jeff Gravelle

“Our Sensible Collection merchandise, like the 40-yr [interest only], are made to meet up with the requires of today’s debtors and open the doorway to hundreds of possible home owners,” claimed Newrez Co-Head of Creation Jeff Gravelle in a assertion.

Newrez states the 40-12 months interest-only solution is accessible for all Clever Sequence goods and is now currently being promoted through all of the company’s lending channels — retail, wholesale, correspondent, joint enterprise and direct-to-consumer.

An curiosity-only personal loan can make month-to-month payments more economical. But except homebuyers make a lot more than the minimum amount every month payment, the only way they obtain extra fairness in their households through the desire-only time period is if their home’s value goes up. And if their home’s benefit depreciates, they can immediately locate themselves “underwater” — owing a lot more on their house loan than their household is worthy of.

Newrez’s SmartSelf mortgage — which it touts as “ideal for self-employed borrowers requiring the use of lender statements and/or asset amortization to qualify” — is not available to first-time homebuyers and requires a bare minimum down payment of 10 p.c for financial loans of up to $2 million. Debtors with fantastic credit history (a credit rating of 740 or higher than) can borrow up to $3 million when putting 20 percent down.

The minimal credit score for most SmartSelf financial loans is 660, but the 40-yr desire-only option requires a minimum amount credit rating score of 680. A borrower with a 680 credit score rating can borrow up to $1.5 million with a 15 percent down payment or $2 million with a 20 % down payment.

Second time about for 40-yr financial loans

Loans with repayment phrases exceeding the 30-year market standard are a strategy which is been experimented with and uncovered wanting ahead of.

Throughout the housing bubble that preceded the 2007-09 mortgage meltdown and the Great Economic downturn, Fannie Mae started out getting 40-calendar year mounted-price home loans right after launching a pilot software in 2004 with credit rating unions.

While the notion was panned at the time by critics together with “The Property finance loan Professor” Jack Guttentag, Fannie Mae expanded the software in 2006, and for a shorter time, a selection of huge-identify lenders like Wells Fargo, Financial institution of The us and Washington Mutual supplied the loans. For a while, there was even discuss that 50-calendar year mortgages may be a very good way to enable homebuyers cope with increasing residence charges.

But when funding for subprime loan companies dried up in 2007 and the housing bubble popped, loan providers like Washington Mutual went beneath, and Fannie and Freddie ended up in governing administration conservatorship in 2008, as possible losses from the subprime property finance loan meltdown mounted.

Home loans with 40- and 50-year phrases disappeared from the scene in advance of taking important current market share. It was subprime loans with lax underwriting requirements and “exotic” features that were blamed for considerably of the runup in house rates during the housing bubble.

Right now, most house loans are “Qualified Mortgages” meeting standards adopted in 2014 to discourage loan providers from giving dangerous loans and to persuade them to thoroughly evaluate each borrower’s capability to repay.

Loan companies who fulfill the QM specifications are granted a legal secure harbor from lawsuits by borrowers, which can make it less complicated to bundle financial loans into property finance loan-backed securities that are bought to traders.

When United kingdom Primary Minister Boris Johnson floated the plan of 50-yr mortgages in July, City Institute fellow Laurie Goodman reported she doubted that home loans with phrases over and above 30 yrs would consider hold in the U.S., since of the trouble of selling these financial loans to secondary market place investors.

“You could go develop a 40-calendar year home loan, but no just one would invest in it,” Goodman advised Inman at the time. “The whole property finance loan procedure is dependent on the 30-yr mortgage loan industry.”

Newrez did not promptly respond to a ask for for comment on whether or not debtors getting out 40-calendar year, curiosity-only financial loans will be at higher chance of default in the party of a downturn, and whether Newrez will be in a position to securitize the loans.

This summer time, non-QM creditors Sprout Property finance loan and 1st Guaranty Property finance loan Corp. have been compelled to end earning financial loans, reportedly for the reason that they experienced hassle offering financial loans to traders when home loan premiums surged in the 1st 50 percent of the calendar year.

Newrez’s mum or dad business New Residential Expenditure Corp., has been expanding its property finance loan financial loan origination business enterprise, allowing it to declare a location between the nation’s prime five nonbank property finance loan loan companies.

Final yr, New Household acquired Caliber Residence Loans for $1.675 billion. As this year’s spring homebuying time kicked off, Newrez declared a partnership with local information platform Patch to market place home loans to potential clients in more than 1,200 communities across the U.S. New Residential also has joint venture partnerships with Realtors, homebuilders and home loan banking companies by way of its subsidiary Shelter Property finance loan Enterprise LLC.

Get Inman’s Extra Credit score Newsletter delivered correct to your inbox. A weekly roundup of all the most significant information in the environment of home loans and closings delivered just about every Wednesday. Click listed here to subscribe.

E mail Matt Carter

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?