Join us at Inman Hook up New York this January for 75+ educational periods, 250+ professional speakers, and networking options with thousands of sector pros. Sign-up nowadays for our Labor Day distinctive level fantastic via September 5! Look at out these just declared speakers for this should-show up at celebration. Sign-up in this article.

When it arrives to actual estate stocks, it has not been their working day, their thirty day period, their week or even their 12 months.

Much more precisely, current times have viewed the current market hammer an array of true estate companies’ share selling prices. In a number of situations, companies have hit all-time lows. And those people new lows in a lot of cases arrive after extra than a calendar year of continuous declines.

The outcome is that publicly traded serious estate organizations are collectively truly worth billions less than they have been in just the current previous, shares have dipped into penny stock territory and in some situations the dangers of insolvency and delisting from the inventory marketplace loom.

The result in of these troubles is more advanced than simply a housing downturn. But either way, if real estate corporations just cannot ultimately flip all-around their inventory current market performances, their slipping share costs could have profound impacts on the actual estate marketplace.

A quite bad week immediately after a quite bad year

The past few days have been certainly brutal to serious estate shares.

Compass shares, for occasion, strike an all-time small value of $2.62 on Thursday. By Friday they had rebounded a little bit to earlier mentioned $2.70, but which is a incredibly considerably cry from the additional than $20 per share, which is wherever they landed following the brokerage’s initial working day of trading back in April 2021. Compass shares have bounced all over about the very last calendar year-and-a-half, but all round the value has been on a consistent downward trajectory.

Credit: Google

Compass will get a ton of attention simply because it’s big and because firm leaders just lately declared a charge-reducing system built to attain profitability for the first time. But the corporation is far from the only organization at present suffering from a rough trip on the stock market place.

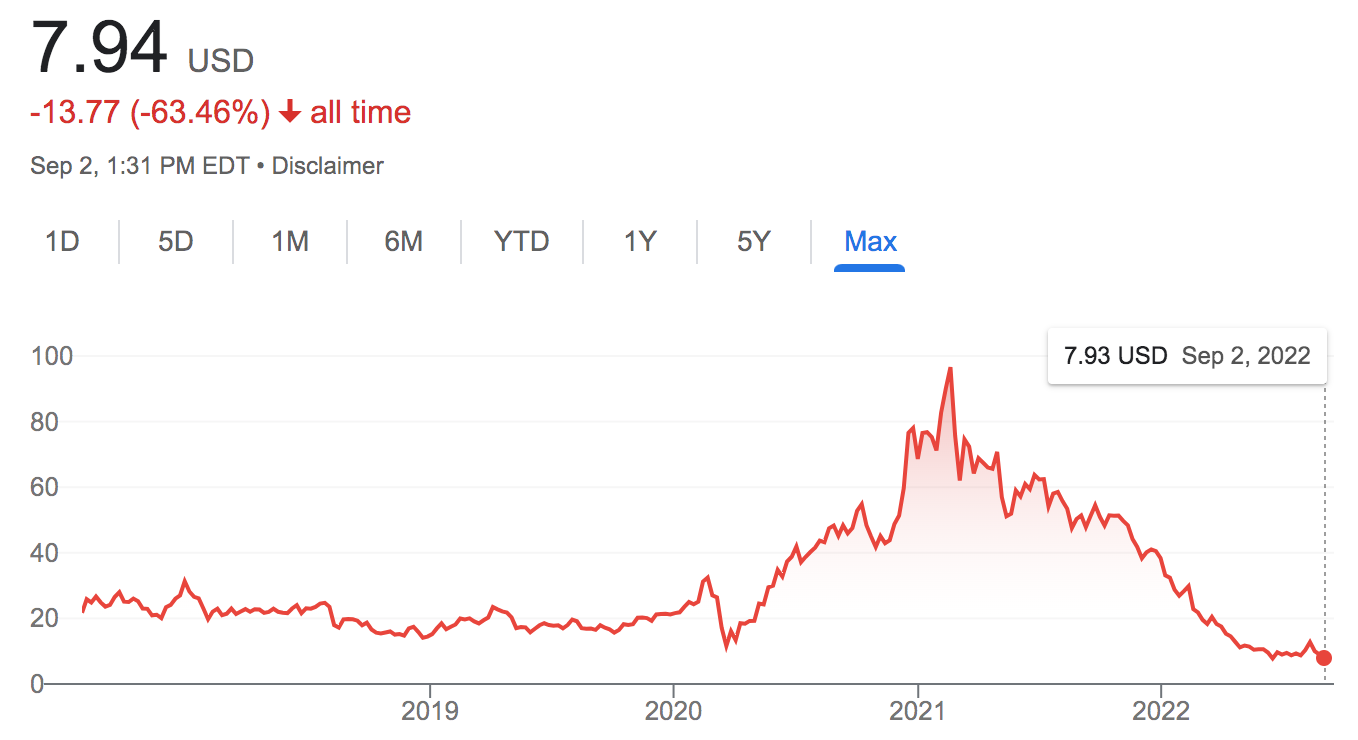

Redfin also strike an all-time reduced this 7 days, with shares dropping to barely extra than $7 Thursday right before rebounding to virtually $8 on Friday. Redfin went community in 2017 so it has a lengthier monitor file compared to Compass. For the initial a number of years the organization available shares, charges hovered in the teenagers and twenties. But commencing in the spring of 2020, shares soared till they at some point reached nearly $100 in February of 2021.

Considering that then, having said that, Redfin’s share price tag has been steadily falling.

Credit score: Google

A equivalent story is actively playing out yet again and all over again between genuine estate companies. Zillow stock was investing for about $34 for each share Friday afternoon — not an all-time lower but nonetheless, a spectacular tumble from the more than $200 shares were being fetching in early 2021.

Opendoor inventory fell to scarcely far more than $4 per share this week, down from both the $10 shares were getting right after the company’s public debut and from the mid $30 selection Opendoor strike in February 2021.

Offerpad, which has the distinction of being the most consistently profitable devoted iBuyer, saw shares drop to $1.40 Friday, an all-time low and precipitous fall from the much more than $10 for each share the enterprise was pulling in just after going public.

Offerpad also presents a case research on what occurs to market place caps — or the valuation of a corporation — when share price ranges fall off a cliff. Offerpad experienced a market cap of about $2.7 billion when it went general public. Right now, the corporation is truly worth a comparatively paltry $347 million. All the corporations with plummeting share costs have viewed similar drops in their current market caps.

Some other companies in real estate have had a relatively tough new previous in the stock market place, however their shares are not bottoming out. Anyplace falls into this group. The company’s shares were trading Friday in the mid $9 array. That is down from all-time highs way back in 2013 and from past fall when shares had been buying and selling in the mid-teens. But it’s up from all-time lows in the spring of 2021.

EXp Environment Holdings, guardian of eXp Realty, has also not hit all-time lows this week. But with shares trading in the mid $12 selection Friday, the organization has nonetheless misplaced a whole lot of floor when compared to February of 2021 when share selling prices neared $80.

Why are shares falling?

Some of the explanations for this sweeping craze are apparent. The inventory market place itself has sputtered more than the previous calendar year, and extra not too long ago the housing market has cooled noticeably. Both are elements in true estate companies’ stock market place struggles.

But most actual estate corporations also commenced struggling perfectly right before the present-day sector downturn, when the housing industry was at its hottest level in many years.

John Campbell

John Campbell — a taking care of director at monetary expert services firm Stephens Inc. who focuses on the actual estate sector — told Inman, that true estate corporations have persistently underperformed relative to the relaxation of the market place.

“The actual estate house is uniquely terrible ideal now,” he claimed.

Campbell said this phenomenon is partially perplexing. Ordinarily when a stock is oversold, he stated, investors will see a deal and start getting it yet again, which drives the value again up rather. But that has not been going on with authentic estate shares.

“This has been perpetual agony to the level that it’s puzzling,” he included.

But it does look like investors’ appetites are leaning into some enterprise models fairly than many others. Campbell pointed out that RE/MAX — which was trading in the mid $22 array Friday and which has been relatively constant because this spring — has underperformed a lot less than other publicly traded true estate companies. Campbell noted much too that RE/MAX is a franchisor, extra akin to a Dunkin Donuts or Papa John’s Pizza than a brokerage like Compass. And that seemingly buoyed RE/MAX shares in the minds of traders.

On the other hand, firms that have been strike in particular challenging contain those people targeted on tech, those people that aren’t lucrative and people that absence any bodily assets. Businesses like Redfin, Offerpad and Compass check a number of — and in some conditions, all — of these bins, Campbell claimed.

“Tech is acquiring wiped out,” he continued. “Unprofitable progress is acquiring wiped out.”

A corporation like Anywhere has some publicity in that regard, but it’s less than that of, say, Compass, which has nonetheless to make cash and which has created know-how a major concentrate. All those differing approaches, then, may possibly explain some of the companies’ diverse fortunes in the inventory market place.

Why does any of this issue?

For serious estate gurus on the ground, inventory industry performances might seem to be like a remote and minimal issue. An agent at Coldwell Banker, right after all, is not likely to see several day-to-day impacts as mother or father business Any place rises and falls on investors’ harmony sheets.

But Campbell explained the inventory marketplace carnage could ultimately have significant impacts on the sector. Most of course, firms such as Compass and eXp have manufactured stocks a big aspect of their pitch. If all those shares are worthless, they are “not a retention resource,” Campbell claimed.

Compass a short while ago ditched its stock application for new agents. But current agents even now keep shares, and in some circumstances, companies have vesting schedules that necessarily mean brokers have to wait around to income out their equity. And there are nonetheless providers these types of as eXp giving stock. All of which suggests that if actual estate businesses carry out poorly in the industry, brokers could decamp to rival brokerages.

That result is not certain and Compass, in certain, is betting that agents will adhere all over for the technological know-how and lifestyle. But Campbell speculated that a firm like Wherever — which doesn’t contain stock as section of its pitch — could attempt to get gain of the current instant and scoop up agents.

Yet another possible threat from these stock sector declines is insolvency. Campbell said that providers with rapid-declining share price ranges could not be ready to meet their financial debt obligations, which can ultimately direct to the existential danger of bankruptcy. Campbell noted that Redfin at the moment has credit card debt, this means it theoretically could confront this possibility at some position, nevertheless Compass does not.

Even organizations exactly where insolvency isn’t a really serious concern could stop up having delisted from the Nasdaq. In order to remain in the market place, corporations have to maintain their share charges above $1. Falling underneath that threshold suggests they can be booted from the marketplace, which both will make it more challenging to trade their shares and can scare absent investors.

Suitable now, most real estate providers however have some wiggle space ahead of they get to the $1 threshold. But the trend strains suggest some are relocating in that route. And a organization like Offerpad was much less than a dollar absent by the conclusion of the 7 days.

Eventually, Campbell mentioned that if actual estate organizations can’t change matters about in the stock industry, traders this sort of as Softbank — the Japanese enterprise fund that fueled the rise of Compass, Opendoor, WeWork and quite a few other people — could in the long run bitter on the sector. When this kind of an outcome could possibly be welcome information to agents and brokerages competing with enterprise-backed behemoths, Campbell recommended that a potential with less financial investment would also be much less dynamic and progressive.

Either way, while, the potential stays unsure — which Campbell claimed is not one thing buyers like.

“Wall Road does considerably far better with bad news than with uncertainty,” he explained. “You just cannot hedge. You just really don’t know what to do.”

E-mail Jim Dalrymple II

Are You Interested in West Eleventh Residences Miami?

Are You Interested in West Eleventh Residences Miami? Are You Interested in ONE Park Tower by Turnberry?

Are You Interested in ONE Park Tower by Turnberry? Are You Interested in Diesel Wynwood Condominium?

Are You Interested in Diesel Wynwood Condominium? Are You Interested in Five Park Miami Beach?

Are You Interested in Five Park Miami Beach? Are You Interested in Cipriani Residences Miami?

Are You Interested in Cipriani Residences Miami? Are You Interested in Bentley Residences Miami?

Are You Interested in Bentley Residences Miami? Are You Interested in Baccarat Residences Brickell?

Are You Interested in Baccarat Residences Brickell? Are You Interested in Aria Reserve Miami?

Are You Interested in Aria Reserve Miami? Are You Interested in 888 Brickell Dolce & Gabbana | Miami?

Are You Interested in 888 Brickell Dolce & Gabbana | Miami? Are You Interested in 600 Miami WorldCenter?

Are You Interested in 600 Miami WorldCenter? Are You Interested in HUB MIAMI RESIDENCES?

Are You Interested in HUB MIAMI RESIDENCES? Are You Interested in WALDORF ASTORIA RESIDENCES?

Are You Interested in WALDORF ASTORIA RESIDENCES?